Is O’Reilly Automotive Inc (NASDAQ:ORLY) a buy here? Prominent investors are taking an optimistic view. The number of bullish hedge fund bets advanced by 2 recently. Our calculations also showed that ORLY isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are numerous tools shareholders use to grade stocks. A duo of the less utilized tools are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the S&P 500 by a healthy amount (see the details here).

Let’s analyze the new hedge fund action surrounding O’Reilly Automotive Inc (NASDAQ:ORLY).

What does the smart money think about O’Reilly Automotive Inc (NASDAQ:ORLY)?

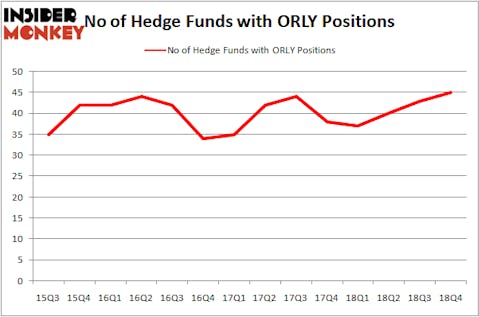

At Q4’s end, a total of 45 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ORLY over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Akre Capital Management was the largest shareholder of O’Reilly Automotive Inc (NASDAQ:ORLY), with a stake worth $649.8 million reported as of the end of September. Trailing Akre Capital Management was Abrams Capital Management, which amassed a stake valued at $296.1 million. Two Sigma Advisors, Millennium Management, and AltaRock Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names have been driving this bullishness. Junto Capital Management, managed by James Parsons, initiated the biggest position in O’Reilly Automotive Inc (NASDAQ:ORLY). Junto Capital Management had $32.4 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $25.7 million position during the quarter. The following funds were also among the new ORLY investors: Robert Pohly’s Samlyn Capital, Peter Muller’s PDT Partners, and Richard Scott Greeder’s Broad Bay Capital.

Let’s go over hedge fund activity in other stocks similar to O’Reilly Automotive Inc (NASDAQ:ORLY). We will take a look at Roper Technologies, Inc. (NYSE:ROP), TD Ameritrade Holding Corp. (NASDAQ:AMTD), Johnson Controls International plc (NYSE:JCI), and Monster Beverage Corp (NASDAQ:MNST). This group of stocks’ market values are similar to ORLY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROP | 29 | 647487 | -3 |

| AMTD | 17 | 494936 | -1 |

| JCI | 26 | 644185 | 10 |

| MNST | 32 | 1256081 | 0 |

| Average | 26 | 760672 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $761 million. That figure was $2000 million in ORLY’s case. Monster Beverage Corp (NASDAQ:MNST) is the most popular stock in this table. On the other hand TD Ameritrade Holding Corp. (NASDAQ:AMTD) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks O’Reilly Automotive Inc (NASDAQ:ORLY) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately ORLY wasn’t in this group. Hedge funds that bet on ORLY were disappointed as the stock returned 7.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.