We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Micro Focus Intl PLC (NYSE:MFGP).

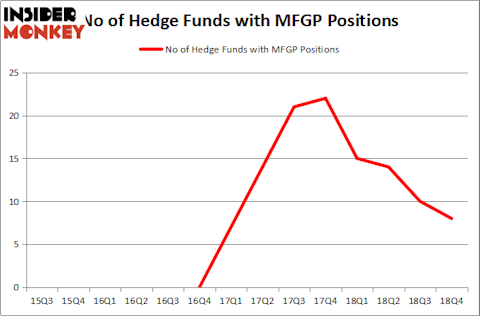

Is Micro Focus Intl PLC (NYSE:MFGP) undervalued? The smart money is becoming less hopeful. The number of long hedge fund positions dropped by 2 lately. Our calculations also showed that MFGP isn’t among the 30 most popular stocks among hedge funds. MFGP was in 8 hedge funds’ portfolios at the end of December. There were 10 hedge funds in our database with MFGP holdings at the end of the previous quarter.

In the 21st century investor’s toolkit there are a large number of indicators shareholders have at their disposal to value publicly traded companies. A pair of the most under-the-radar indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass their index-focused peers by a superb margin (see the details here).

We’re going to take a look at the recent hedge fund action regarding Micro Focus Intl PLC (NYSE:MFGP).

What does the smart money think about Micro Focus Intl PLC (NYSE:MFGP)?

Heading into the first quarter of 2019, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MFGP over the last 14 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of Micro Focus Intl PLC (NYSE:MFGP), with a stake worth $4.4 million reported as of the end of September. Trailing Arrowstreet Capital was Prescott Group Capital Management, which amassed a stake valued at $2.4 million. Millennium Management, Two Sigma Advisors, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Since Micro Focus Intl PLC (NYSE:MFGP) has faced declining sentiment from hedge fund managers, logic holds that there was a specific group of money managers who were dropping their positions entirely in the third quarter. Intriguingly, Paul Singer’s Elliott Management dropped the largest investment of all the hedgies watched by Insider Monkey, totaling about $115.5 million in stock, and Richard Barrera’s Roystone Capital Partners was right behind this move, as the fund cut about $29.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Micro Focus Intl PLC (NYSE:MFGP). We will take a look at SEI Investments Company (NASDAQ:SEIC), Paycom Software Inc (NYSE:PAYC), Aramark (NYSE:ARMK), and Snap Inc. (NYSE:SNAP). This group of stocks’ market valuations resemble MFGP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SEIC | 25 | 287486 | 1 |

| PAYC | 19 | 148642 | -4 |

| ARMK | 39 | 907568 | 4 |

| SNAP | 17 | 346942 | 0 |

| Average | 25 | 422660 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $423 million. That figure was $9 million in MFGP’s case. Aramark (NYSE:ARMK) is the most popular stock in this table. On the other hand Snap Inc. (NYSE:SNAP) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Micro Focus Intl PLC (NYSE:MFGP) is even less popular than SNAP. Clearly hedge funds dropped the ball on MFGP and missed out on very strong gains. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Only a few hedge funds were also right about betting on MFGP as the stock returned 52.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.