At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards The Bank of New York Mellon Corporation (NYSE:BK).

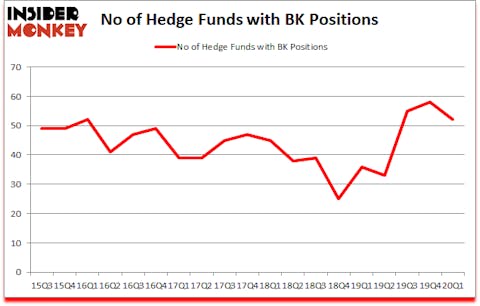

Is The Bank of New York Mellon Corporation (NYSE:BK) a healthy stock for your portfolio? Investors who are in the know are taking a pessimistic view. The number of long hedge fund positions shrunk by 6 recently. Our calculations also showed that BK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72% since March 2017 and outperformed the S&P 500 ETFs by more than 44 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Nelson Peltz of Trian Partners

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we are still not out of the woods in terms of the coronavirus pandemic. So, we checked out this analyst’s “corona catalyst plays“. We interview hedge fund managers and ask them about best ideas. You can watch our latest hedge fund manager interview here and find out the name of the large-cap healthcare stock that Sio Capital’s Michael Castor expects to double. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s check out the recent hedge fund action regarding The Bank of New York Mellon Corporation (NYSE:BK).

Hedge fund activity in The Bank of New York Mellon Corporation (NYSE:BK)

At Q1’s end, a total of 52 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -10% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BK over the last 18 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in The Bank of New York Mellon Corporation (NYSE:BK) was held by Berkshire Hathaway, which reported holding $2686.5 million worth of stock at the end of September. It was followed by Trian Partners with a $326.7 million position. Other investors bullish on the company included Citadel Investment Group, D E Shaw, and Yacktman Asset Management. In terms of the portfolio weights assigned to each position Prana Capital Management allocated the biggest weight to The Bank of New York Mellon Corporation (NYSE:BK), around 10.52% of its 13F portfolio. LFL Advisers is also relatively very bullish on the stock, dishing out 9.13 percent of its 13F equity portfolio to BK.

Since The Bank of New York Mellon Corporation (NYSE:BK) has witnessed declining sentiment from hedge fund managers, we can see that there exists a select few fund managers who sold off their entire stakes in the third quarter. Interestingly, Ravi Chopra’s Azora Capital cut the biggest stake of the 750 funds watched by Insider Monkey, valued at about $18.4 million in stock. Renaissance Technologies, also said goodbye to its stock, about $13.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 6 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Bank of New York Mellon Corporation (NYSE:BK) but similarly valued. These stocks are Mizuho Financial Group Inc. (NYSE:MFG), Dell Technologies Inc. (NYSE:DELL), Emerson Electric Co. (NYSE:EMR), and The Allstate Corporation (NYSE:ALL). This group of stocks’ market valuations resemble BK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFG | 6 | 23691 | 1 |

| DELL | 39 | 1967686 | -2 |

| EMR | 33 | 434014 | -8 |

| ALL | 43 | 1535993 | 6 |

| Average | 30.25 | 990346 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $990 million. That figure was $4402 million in BK’s case. The Allstate Corporation (NYSE:ALL) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (NYSE:MFG) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks The Bank of New York Mellon Corporation (NYSE:BK) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd and still beat the market by 15.6 percentage points. Unfortunately BK wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on BK were disappointed as the stock returned 3.3% during the second quarter (through May 22nd) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Disclosure: None. This article was originally published at Insider Monkey.