Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The last 12 months is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Lazard Ltd (NYSE:LAZ).

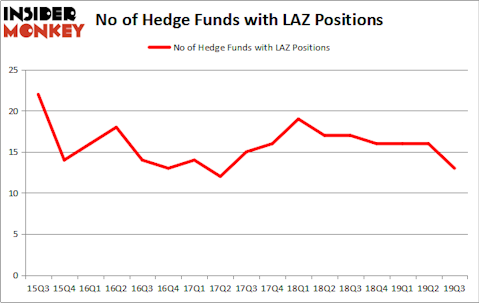

Lazard Ltd (NYSE:LAZ) was in 13 hedge funds’ portfolios at the end of September. LAZ investors should be aware of a decrease in activity from the world’s largest hedge funds lately. There were 16 hedge funds in our database with LAZ positions at the end of the previous quarter. Our calculations also showed that LAZ isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Mason Hawkins of Southeastern Asset Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s view the fresh hedge fund action regarding Lazard Ltd (NYSE:LAZ).

Hedge fund activity in Lazard Ltd (NYSE:LAZ)

Heading into the fourth quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -19% from the previous quarter. The graph below displays the number of hedge funds with bullish position in LAZ over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Lazard Ltd (NYSE:LAZ) was held by Southeastern Asset Management, which reported holding $252.6 million worth of stock at the end of September. It was followed by Ariel Investments with a $206.2 million position. Other investors bullish on the company included Fisher Asset Management, Royce & Associates, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Southeastern Asset Management allocated the biggest weight to Lazard Ltd (NYSE:LAZ), around 4.41% of its 13F portfolio. Ariel Investments is also relatively very bullish on the stock, setting aside 2.75 percent of its 13F equity portfolio to LAZ.

Due to the fact that Lazard Ltd (NYSE:LAZ) has faced bearish sentiment from the aggregate hedge fund industry, we can see that there was a specific group of hedge funds that decided to sell off their full holdings heading into Q4. At the top of the heap, Daniel Lascano’s Lomas Capital Management cut the largest stake of all the hedgies monitored by Insider Monkey, comprising about $14.1 million in stock, and Curtis Schenker and Craig Effron’s Scoggin was right behind this move, as the fund cut about $1.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds heading into Q4.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Lazard Ltd (NYSE:LAZ) but similarly valued. These stocks are Viper Energy Partners LP (NASDAQ:VNOM), nVent Electric plc (NYSE:NVT), Ollie’s Bargain Outlet Holdings Inc (NASDAQ:OLLI), and Spark Therapeutics Inc (NASDAQ:ONCE). This group of stocks’ market valuations resemble LAZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNOM | 14 | 130553 | 1 |

| NVT | 21 | 564545 | -7 |

| OLLI | 22 | 98695 | -9 |

| ONCE | 36 | 1272087 | -3 |

| Average | 23.25 | 516470 | -4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $516 million. That figure was $601 million in LAZ’s case. Spark Therapeutics Inc (NASDAQ:ONCE) is the most popular stock in this table. On the other hand Viper Energy Partners LP (NASDAQ:VNOM) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Lazard Ltd (NYSE:LAZ) is even less popular than VNOM. Hedge funds clearly dropped the ball on LAZ as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on LAZ as the stock returned 11.8% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.