Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Cabot Corporation (NYSE:CBT).

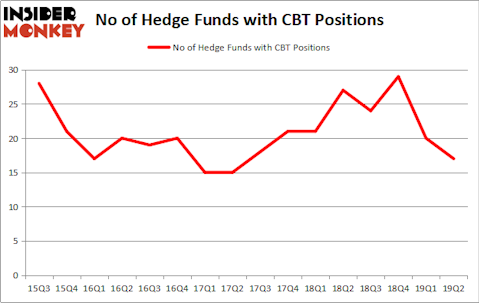

Cabot Corporation (NYSE:CBT) investors should be aware of a decrease in hedge fund sentiment lately. Our calculations also showed that CBT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the new hedge fund action regarding Cabot Corporation (NYSE:CBT).

What does smart money think about Cabot Corporation (NYSE:CBT)?

At Q2’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the first quarter of 2019. On the other hand, there were a total of 27 hedge funds with a bullish position in CBT a year ago. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Robert Rodriguez and Steven Romick’s First Pacific Advisors LLC has the biggest position in Cabot Corporation (NYSE:CBT), worth close to $31.9 million, amounting to 0.3% of its total 13F portfolio. On First Pacific Advisors LLC’s heels is AQR Capital Management, led by Cliff Asness, holding a $27.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions include Chuck Royce’s Royce & Associates, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Judging by the fact that Cabot Corporation (NYSE:CBT) has witnessed declining sentiment from hedge fund managers, we can see that there exists a select few hedgies who were dropping their positions entirely last quarter. Intriguingly, Renaissance Technologies dumped the biggest stake of the 750 funds monitored by Insider Monkey, comprising about $5.7 million in stock. Steve Cohen’s fund, Point72 Asset Management, also dumped its stock, about $3.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 3 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cabot Corporation (NYSE:CBT) but similarly valued. We will take a look at AVX Corporation (NYSE:AVX), Tenable Holdings, Inc. (NASDAQ:TENB), Finisar Corporation (NASDAQ:FNSR), and Nextera Energy Partners LP (NYSE:NEP). This group of stocks’ market values are closest to CBT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVX | 11 | 80537 | 0 |

| TENB | 17 | 146916 | -3 |

| FNSR | 15 | 354017 | 1 |

| NEP | 13 | 51281 | 4 |

| Average | 14 | 158188 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $158 million. That figure was $124 million in CBT’s case. Tenable Holdings, Inc. (NASDAQ:TENB) is the most popular stock in this table. On the other hand AVX Corporation (NYSE:AVX) is the least popular one with only 11 bullish hedge fund positions. Cabot Corporation (NYSE:CBT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CBT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CBT were disappointed as the stock returned -4.1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.