Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Ares Management Corporation (NYSE:ARES) from the perspective of those elite funds.

Ares Management Corporation (NYSE:ARES) shareholders have witnessed a decrease in hedge fund sentiment recently. Our calculations also showed that ARES isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a multitude of gauges investors put to use to appraise publicly traded companies. Two of the less known gauges are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the best fund managers can trounce their index-focused peers by a superb amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the recent hedge fund action regarding Ares Management Corporation (NYSE:ARES).

Hedge fund activity in Ares Management Corporation (NYSE:ARES)

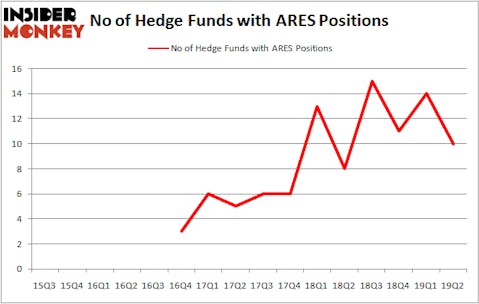

Heading into the third quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -29% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ARES over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the biggest position in Ares Management Corporation (NYSE:ARES). Royce & Associates has a $116.2 million position in the stock, comprising 1.1% of its 13F portfolio. The second largest stake is held by Citadel Investment Group, managed by Ken Griffin, which holds a $38.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers that are bullish include Matthew Drapkin and Steven R. Becker’s Becker Drapkin Management, Renaissance Technologies and Joseph Samuels’s Islet Management.

Since Ares Management Corporation (NYSE:ARES) has experienced a decline in interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedgies who were dropping their entire stakes heading into Q3. It’s worth mentioning that Israel Englander’s Millennium Management dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, valued at about $22.1 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund cut about $13.5 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Ares Management Corporation (NYSE:ARES). We will take a look at Arrow Electronics, Inc. (NYSE:ARW), Kemper Corporation (NYSE:KMPR), Elastic N.V. (NYSE:ESTC), and Aluminum Corp. of China Limited (NYSE:ACH). This group of stocks’ market caps resemble ARES’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARW | 17 | 385523 | -5 |

| KMPR | 19 | 172679 | 11 |

| ESTC | 27 | 402508 | 9 |

| ACH | 5 | 5052 | 1 |

| Average | 17 | 241441 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $241 million. That figure was $181 million in ARES’s case. Elastic N.V. (NYSE:ESTC) is the most popular stock in this table. On the other hand Aluminum Corp. of China Limited (NYSE:ACH) is the least popular one with only 5 bullish hedge fund positions. Ares Management Corporation (NYSE:ARES) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on ARES, though not to the same extent, as the stock returned 3.5% during the third quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.