Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Ares Management L.P. (NYSE:ARES) and see how the stock is affected by the recent hedge fund activity.

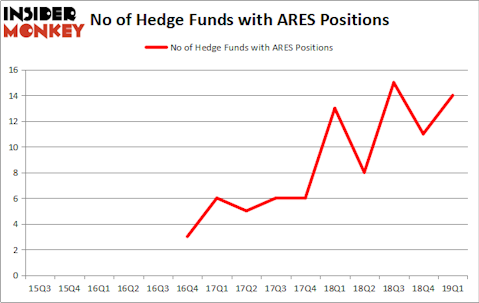

Ares Management L.P. (NYSE:ARES) was in 14 hedge funds’ portfolios at the end of the first quarter of 2019. ARES has experienced an increase in enthusiasm from smart money lately. There were 11 hedge funds in our database with ARES holdings at the end of the previous quarter. Our calculations also showed that ARES isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to go over the latest hedge fund action surrounding Ares Management L.P. (NYSE:ARES).

Hedge fund activity in Ares Management L.P. (NYSE:ARES)

At Q1’s end, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ARES over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Royce & Associates was the largest shareholder of Ares Management L.P. (NYSE:ARES), with a stake worth $117.7 million reported as of the end of March. Trailing Royce & Associates was Citadel Investment Group, which amassed a stake valued at $49 million. Millennium Management, Becker Drapkin Management, and Point72 Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, specific money managers have been driving this bullishness. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, initiated the largest position in Ares Management L.P. (NYSE:ARES). BlueCrest Capital Mgmt. had $1.5 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $0.9 million position during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, David Harding’s Winton Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s check out hedge fund activity in other stocks similar to Ares Management L.P. (NYSE:ARES). These stocks are Prospect Capital Corporation (NASDAQ:PSEC), Baozun Inc (NASDAQ:BZUN), EVO Payments, Inc. (NASDAQ:EVOP), and Mednax Inc. (NYSE:MD). This group of stocks’ market caps are closest to ARES’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PSEC | 11 | 16611 | 0 |

| BZUN | 14 | 60742 | 0 |

| EVOP | 13 | 61327 | 3 |

| MD | 23 | 298044 | -2 |

| Average | 15.25 | 109181 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $232 million in ARES’s case. Mednax Inc. (NYSE:MD) is the most popular stock in this table. On the other hand Prospect Capital Corporation (NASDAQ:PSEC) is the least popular one with only 11 bullish hedge fund positions. Ares Management L.P. (NYSE:ARES) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on ARES as the stock returned 21.9% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.