Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of McKesson Corporation (NYSE:MCK).

Is McKesson Corporation (NYSE:MCK) worth your attention right now? The best stock pickers are getting more optimistic. The number of bullish hedge fund positions increased by 4 lately. Our calculations also showed that MCK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the new hedge fund action regarding McKesson Corporation (NYSE:MCK).

What have hedge funds been doing with McKesson Corporation (NYSE:MCK)?

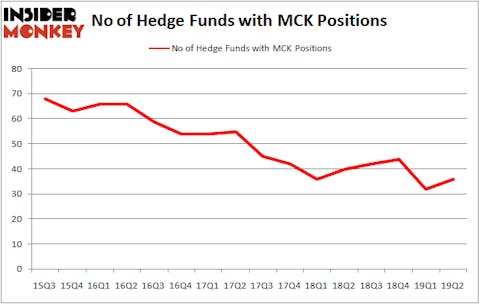

At the end of the second quarter, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in MCK over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Glenview Capital, managed by Larry Robbins, holds the number one position in McKesson Corporation (NYSE:MCK). Glenview Capital has a $605.5 million position in the stock, comprising 5.5% of its 13F portfolio. The second largest stake is held by Richard S. Pzena of Pzena Investment Management, with a $518.9 million position; 2.7% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish encompass Seth Klarman’s Baupost Group, Cliff Asness’s AQR Capital Management and Israel Englander’s Millennium Management.

As aggregate interest increased, key hedge funds were breaking ground themselves. Tavio Capital, managed by Amy Mulderry, created the most valuable position in McKesson Corporation (NYSE:MCK). Tavio Capital had $20.2 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $9.9 million position during the quarter. The following funds were also among the new MCK investors: Michael Kharitonov and Jon David McAuliffe’s Voleon Capital, Matthew Hulsizer’s PEAK6 Capital Management, and William B. Gray’s Orbis Investment Management.

Let’s go over hedge fund activity in other stocks similar to McKesson Corporation (NYSE:MCK). We will take a look at BT Group plc (NYSE:BT), Willis Towers Watson Public Limited Company (NASDAQ:WLTW), Royal Caribbean Cruises Ltd. (NYSE:RCL), and Cintas Corporation (NASDAQ:CTAS). All of these stocks’ market caps resemble MCK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BT | 12 | 83150 | -2 |

| WLTW | 33 | 1693637 | 0 |

| RCL | 46 | 1329751 | -1 |

| CTAS | 27 | 552648 | 0 |

| Average | 29.5 | 914797 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $915 million. That figure was $2071 million in MCK’s case. Royal Caribbean Cruises Ltd. (NYSE:RCL) is the most popular stock in this table. On the other hand BT Group plc (NYSE:BT) is the least popular one with only 12 bullish hedge fund positions. McKesson Corporation (NYSE:MCK) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on MCK, though not to the same extent, as the stock returned 2% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.