Is West Fraser Timber Co. Ltd. (NYSE:WFG) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

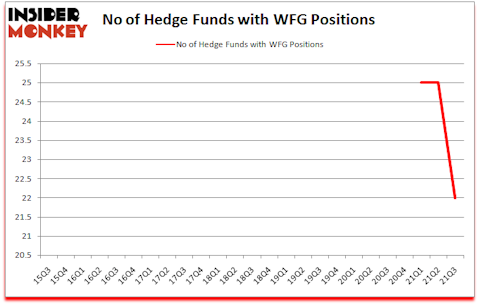

Is West Fraser Timber Co. Ltd. (NYSE:WFG) a bargain? Hedge funds were selling. The number of bullish hedge fund bets fell by 3 in recent months. West Fraser Timber Co. Ltd. (NYSE:WFG) was in 22 hedge funds’ portfolios at the end of September. The all time high for this statistic is 25. Our calculations also showed that WFG isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 25 hedge funds in our database with WFG holdings at the end of June.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s view the key hedge fund action surrounding West Fraser Timber Co. Ltd. (NYSE:WFG).

Ken Heebner of Capital Growth Management

Do Hedge Funds Think WFG Is A Good Stock To Buy Now?

At the end of September, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from the previous quarter. By comparison, 0 hedge funds held shares or bullish call options in WFG a year ago. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in West Fraser Timber Co. Ltd. (NYSE:WFG), which was worth $141.4 million at the end of the third quarter. On the second spot was Impala Asset Management which amassed $91.1 million worth of shares. Scopus Asset Management, Waratah Capital Advisors, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Impala Asset Management allocated the biggest weight to West Fraser Timber Co. Ltd. (NYSE:WFG), around 6.47% of its 13F portfolio. NewGen Asset Management is also relatively very bullish on the stock, earmarking 5.91 percent of its 13F equity portfolio to WFG.

Judging by the fact that West Fraser Timber Co. Ltd. (NYSE:WFG) has faced a decline in interest from the smart money, logic holds that there is a sect of funds that decided to sell off their positions entirely last quarter. Interestingly, Renaissance Technologies dropped the biggest position of the 750 funds monitored by Insider Monkey, valued at an estimated $21.9 million in call options. Robert Bishop’s fund, Impala Asset Management, also said goodbye to its call options, about $17.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as West Fraser Timber Co. Ltd. (NYSE:WFG) but similarly valued. These stocks are XPO Logistics Inc (NYSE:XPO), Tempur Sealy International Inc. (NYSE:TPX), Concentrix Corporation (NASDAQ:CNXC), AECOM (NYSE:ACM), Biohaven Pharmaceutical Holding Company Ltd. (NYSE:BHVN), Algonquin Power & Utilities Corp. (NYSE:AQN), and Neurocrine Biosciences, Inc. (NASDAQ:NBIX). This group of stocks’ market values are closest to WFG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XPO | 49 | 1833910 | -8 |

| TPX | 37 | 1299293 | 2 |

| CNXC | 21 | 586853 | 0 |

| ACM | 39 | 783809 | 7 |

| BHVN | 33 | 1063983 | 6 |

| AQN | 15 | 152646 | -9 |

| NBIX | 31 | 980578 | -1 |

| Average | 32.1 | 957296 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.1 hedge funds with bullish positions and the average amount invested in these stocks was $957 million. That figure was $514 million in WFG’s case. XPO Logistics Inc (NYSE:XPO) is the most popular stock in this table. On the other hand Algonquin Power & Utilities Corp. (NYSE:AQN) is the least popular one with only 15 bullish hedge fund positions. West Fraser Timber Co. Ltd. (NYSE:WFG) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for WFG is 38.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. A small number of hedge funds were also right about betting on WFG as the stock returned 13.5% since the end of the third quarter (through 12/31) and outperformed the market by an even larger margin.

Follow West Fraser Timber Co. Ltd (NYSE:WFG)

Follow West Fraser Timber Co. Ltd (NYSE:WFG)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Steel Stocks To Buy

- 10 Best Spring Stocks to Buy Now

- 15 Most Valuable Cloud Computing Companies

Disclosure: None. This article was originally published at Insider Monkey.