In this article we will analyze whether Illinois Tool Works Inc. (NYSE:ITW) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market by double digits annually.

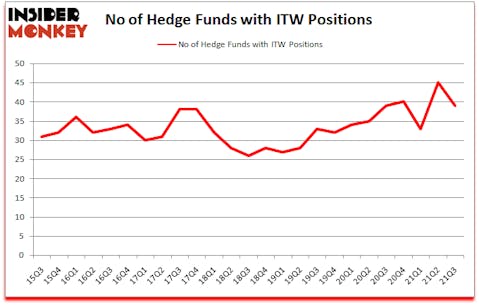

Is Illinois Tool Works Inc. (NYSE:ITW) ready to rally soon? The smart money was in a pessimistic mood. The number of long hedge fund bets dropped by 6 recently. Illinois Tool Works Inc. (NYSE:ITW) was in 39 hedge funds’ portfolios at the end of September. The all time high for this statistic is 45. Our calculations also showed that ITW isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we’re going to take a peek at the fresh hedge fund action encompassing Illinois Tool Works Inc. (NYSE:ITW).

Tom Gayner of Markel Gayner Asset Management

Do Hedge Funds Think ITW Is A Good Stock To Buy Now?

At third quarter’s end, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ITW over the last 25 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the biggest position in Illinois Tool Works Inc. (NYSE:ITW). AQR Capital Management has a $191.7 million position in the stock, comprising 0.4% of its 13F portfolio. The second most bullish fund manager is Tom Gayner of Markel Gayner Asset Management, with a $67.7 million position; 0.9% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism comprise Israel Englander’s Millennium Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Arjuna Capital allocated the biggest weight to Illinois Tool Works Inc. (NYSE:ITW), around 1.62% of its 13F portfolio. Markel Gayner Asset Management is also relatively very bullish on the stock, setting aside 0.86 percent of its 13F equity portfolio to ITW.

Because Illinois Tool Works Inc. (NYSE:ITW) has witnessed declining sentiment from the smart money, we can see that there were a few fund managers who sold off their full holdings by the end of the third quarter. Intriguingly, Ray Dalio’s Bridgewater Associates sold off the biggest position of all the hedgies watched by Insider Monkey, worth an estimated $19.6 million in stock, and Phill Gross and Robert Atchinson’s Adage Capital Management was right behind this move, as the fund said goodbye to about $18 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 6 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Illinois Tool Works Inc. (NYSE:ITW) but similarly valued. We will take a look at Regeneron Pharmaceuticals Inc (NASDAQ:REGN), Intercontinental Exchange Inc (NYSE:ICE), Bank of Montreal (NYSE:BMO), Aon plc (NYSE:AON), Colgate-Palmolive Company (NYSE:CL), Illumina, Inc. (NASDAQ:ILMN), and Waste Management, Inc. (NYSE:WM). This group of stocks’ market caps resemble ITW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| REGN | 44 | 1318026 | -4 |

| ICE | 48 | 2832226 | 1 |

| BMO | 12 | 142342 | 0 |

| AON | 47 | 6005008 | -21 |

| CL | 54 | 2577652 | -4 |

| ILMN | 55 | 2801228 | 4 |

| WM | 36 | 3629155 | -3 |

| Average | 42.3 | 2757948 | -3.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 42.3 hedge funds with bullish positions and the average amount invested in these stocks was $2758 million. That figure was $422 million in ITW’s case. Illumina, Inc. (NASDAQ:ILMN) is the most popular stock in this table. On the other hand Bank of Montreal (NYSE:BMO) is the least popular one with only 12 bullish hedge fund positions. Illinois Tool Works Inc. (NYSE:ITW) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for ITW is 56.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 28.6% in 2021 through November 30th and still beat the market by 5.6 percentage points. A small number of hedge funds were also right about betting on ITW as the stock returned 12.4% since the end of the third quarter (through 11/30) and outperformed the market by an even larger margin.

Follow Illinois Tool Works Inc (NYSE:ITW)

Follow Illinois Tool Works Inc (NYSE:ITW)

Receive real-time insider trading and news alerts

Suggested Articles:

- 14 Best Low Risk Stocks To Buy Now

- 10 Best Construction Materials Stocks To Buy Now

- 25 Most Subscribed YouTube Channels in 2021

Disclosure: None. This article was originally published at Insider Monkey.