The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 730 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 28th, 2019. In this article we are going to take a look at smart money sentiment towards Erie Indemnity Company (NASDAQ:ERIE).

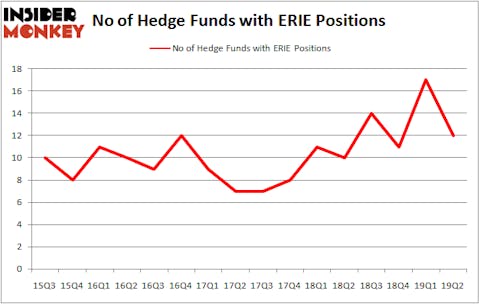

Is Erie Indemnity Company (NASDAQ:ERIE) a good investment right now? The smart money is taking a pessimistic view. The number of long hedge fund positions fell by 5 recently. Our calculations also showed that ERIE isn’t among the 30 most popular stocks among hedge funds (view the video below). ERIE was in 12 hedge funds’ portfolios at the end of June. There were 17 hedge funds in our database with ERIE holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are many signals shareholders use to appraise their holdings. A pair of the most under-the-radar signals are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can trounce the broader indices by a healthy margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the key hedge fund action regarding Erie Indemnity Company (NASDAQ:ERIE).

Hedge fund activity in Erie Indemnity Company (NASDAQ:ERIE)

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -29% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ERIE over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the largest position in Erie Indemnity Company (NASDAQ:ERIE). Royce & Associates has a $51.7 million position in the stock, comprising 0.5% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, led by Cliff Asness, holding a $21.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions consist of Ken Griffin’s Citadel Investment Group, D. E. Shaw’s D E Shaw and Noam Gottesman’s GLG Partners.

Seeing as Erie Indemnity Company (NASDAQ:ERIE) has experienced a decline in interest from the smart money, logic holds that there lies a certain “tier” of fund managers who sold off their positions entirely last quarter. Intriguingly, Renaissance Technologies dropped the largest stake of the 750 funds monitored by Insider Monkey, totaling about $23.1 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund cut about $3.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 5 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Erie Indemnity Company (NASDAQ:ERIE). We will take a look at Host Hotels and Resorts Inc (NYSE:HST), The J.M. Smucker Company (NYSE:SJM), Fortinet Inc (NASDAQ:FTNT), and Tractor Supply Company (NASDAQ:TSCO). This group of stocks’ market caps resemble ERIE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HST | 28 | 513326 | 1 |

| SJM | 26 | 486152 | 0 |

| FTNT | 34 | 1151583 | 0 |

| TSCO | 35 | 652759 | 2 |

| Average | 30.75 | 700955 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $701 million. That figure was $89 million in ERIE’s case. Tractor Supply Company (NASDAQ:TSCO) is the most popular stock in this table. On the other hand The J.M. Smucker Company (NYSE:SJM) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Erie Indemnity Company (NASDAQ:ERIE) is even less popular than SJM. Hedge funds dodged a bullet by taking a bearish stance towards ERIE. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ERIE wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ERIE investors were disappointed as the stock returned -26.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.