Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Halcon Resources Corp (NYSE:HK) to find out whether it was one of their high conviction long-term ideas.

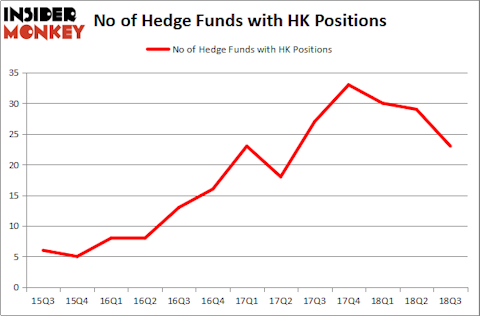

Is Halcon Resources Corp (NYSE:HK) a first-rate investment today? Prominent investors are getting less bullish. The number of bullish hedge fund positions shrunk by 6 in recent months. Our calculations also showed that HK isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s go over the key hedge fund action surrounding Halcon Resources Corp (NYSE:HK).

What does the smart money think about Halcon Resources Corp (NYSE:HK)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from one quarter earlier. By comparison, 33 hedge funds held shares or bullish call options in HK heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jeffrey Tannenbaum’s Fir Tree has the largest position in Halcon Resources Corp (NYSE:HK), worth close to $37.5 million, amounting to 2% of its total 13F portfolio. On Fir Tree’s heels is Israel Englander of Millennium Management, with a $32.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers with similar optimism comprise Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Don Morgan’s Brigade Capital and Marc Lisker, Glenn Fuhrman and John Phelan’s MSDC Management.

Since Halcon Resources Corp (NYSE:HK) has experienced falling interest from hedge fund managers, we can see that there was a specific group of funds who were dropping their positions entirely heading into Q3. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital sold off the largest position of the “upper crust” of funds monitored by Insider Monkey, worth close to $6 million in stock. Bart Baum’s fund, Ionic Capital Management, also dumped its stock, about $4.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 6 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Halcon Resources Corp (NYSE:HK). These stocks are HomeStreet Inc (NASDAQ:HMST), Investment Technology Group, Inc. (NYSE:ITG), Investors Real Estate Trust (NYSE:IRET), and Novavax, Inc. (NASDAQ:NVAX). This group of stocks’ market valuations match HK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMST | 6 | 23783 | -1 |

| ITG | 10 | 30170 | -3 |

| IRET | 7 | 34096 | 0 |

| NVAX | 12 | 23480 | 1 |

| Average | 8.75 | 27882 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.75 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $249 million in HK’s case. Novavax, Inc. (NASDAQ:NVAX) is the most popular stock in this table. On the other hand HomeStreet Inc (NASDAQ:HMST) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Halcon Resources Corp (NYSE:HK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.