Och-Ziff Hedge Fund Had $7.6 Billion in Outflows Last Year (Bloomberg)

Och-Ziff Capital Management Group LLC saw $7.6 billion in client withdrawals last year despite posting the best performance in his flagship hedge fund since 2013, the company said in a statement Friday. Still, the firm, founded by the former arbitrage trader in 1994, collected inflows to start 2018 off right. While redemptions have slowed, Och’s New York-based firm had a tumultuous time as it grappled with the aftermath of settling a five-year bribery probe, last-minute changes to Och’s succession plan, and its shares hitting record lows. It’s now up to Robert Shafir, a former executive at Credit Suisse Group AG who succeeded Och as chief executive officer on Feb. 5, to lead the turnaround.

Backstory: Warren Buffett’s Valentine’s Day Surprise for Investors (Reuters)

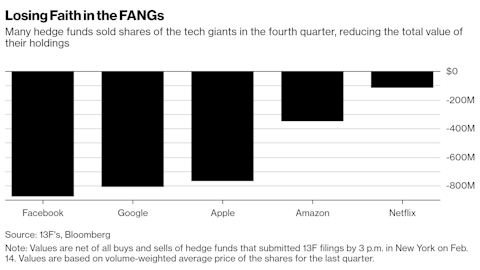

NEW YORK (Reuters) – Warren Buffett had a Valentine’s Day surprise for investors in Teva Pharmaceutical Industries Ltd (TEVA.TA). A regulatory filing with the U.S. Securities and Exchange Commission (SEC), known as a 13F, showed that Buffett’s Berkshire Hathaway Inc (BRKa.N) took a stake in the generic drugmaker in the fourth quarter of 2017. The news pushed Teva shares up more than 10 percent on Feb. 14. Hedge funds are notably hush hush about their portfolio holdings. Quarterly disclosures offer a look at what influential money managers are buying and selling.

Maxx-Studio/Shutterstock.com

Bezeq Is Said to Accept Elliott Demand to Hire New Directors (Bloomberg)

Bezeq Israeli Telecommunication Corp. plans to bow to demands from hedge fund Elliott Management Corp. that it hire new directors to run the company, according to a person familiar with the matter. Bezeq’s board of directors will form a subcommittee with members who aren’t linked to majority shareholder Shaul Elovitch to find new directors for the firm, said the person, asking not to be identified because the discussions are private. The committee will also work with an executive search firm to make the hiring process more transparent, the person said. Elliott, the New York-based fund founded by billionaire Paul Singer, in January increased its stake in Bezeq, Israel’s largest telecommunications firm, and called for changes to its ownership structure to improve its flagging performance.

Soros Lobbies ECB for More Euro Zone Integration, Draws Criticism (Reuters)

FRANKFURT (Reuters) – Billionaire investor and activist George Soros has met a European Central Bank director to argue for closer euro zone integration, prompting criticism from some EU lawmakers who fear he is exerting undue influence on a sensitive political issue. The Hungarian-born financier is a veteran advocate of European unity whose championing of liberal causes over decades has earned him many enemies, including Hungary’s nationalist Prime Minister Viktor Orban and some Brexit supporters. Soros held a private meeting on Nov. 14 with Benoit Coeure, a member of the six-strong board that steers ECB policy, to discuss “euro area deepening”, according to a part of Coeure’s diary published on Thursday.

Dan Loeb Ready To Pitch New Hedge Fund Drama (DealBreaker)

A few years ago, Dan Loeb offered some unsolicited film criticism. This did not go over well in his hometown, where he was met with the withering scorn of George Clooney. That George Clooney likely has no idea that Loeb is a native Angeleno takes none of the sting out that “carpetbagger” put-down. Anyway, in the face of Clooneyan wrath, Loeb had to rather humiliatingly back down. But dammit if he doesn’t still want to be in pictures. Dan Loeb’s Third Point hedge fund took a 2 million share stake in Netflix in the fourth quarter of last year, according to a filing released Wednesday…

Brevan Howard Opens Back-Office Unit to Hedge Fund Rivals (FNLondon.com)

Brevan Howard Asset Management is spinning out its back-office operations to create a platform to host rival hedge fund managers. The as-yet unnamed business will provide a new source of revenues for the firm, which has seen a decline in assets — from a peak of $40bn in 2013 to $13bn in 2017 — during a difficult period for global macro managers. The move comes as firms, including Fortress Investment Group and DE Shaw Group, take similar steps to profit from a growing number of money managers looking to cut fixed costs by outsourcing their requirements, including compliance and risk management, to third parties.