Last year we predicted the arrival of the first US recession since 2009 and we told in advance that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL).

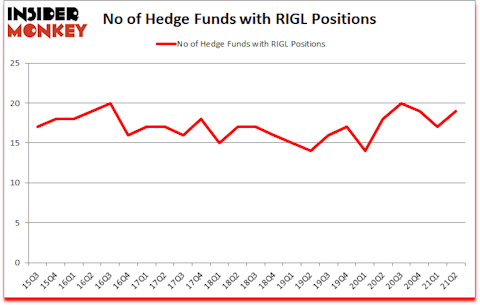

Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) has experienced an increase in hedge fund sentiment in recent months. Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 20. Our calculations also showed that RIGL isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

To most shareholders, hedge funds are assumed to be underperforming, old financial vehicles of years past. While there are over 8000 funds trading at the moment, Our experts look at the masters of this club, approximately 850 funds. These investment experts preside over the lion’s share of all hedge funds’ total capital, and by monitoring their highest performing stock picks, Insider Monkey has uncovered several investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Kris Jenner of Rock Springs Capital Management

Now let’s take a look at the latest hedge fund action encompassing Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL).

Do Hedge Funds Think RIGL Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in RIGL a year ago. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) was held by Tamarack Capital Management, which reported holding $27.8 million worth of stock at the end of June. It was followed by Rock Springs Capital Management with a $20.6 million position. Other investors bullish on the company included Millennium Management, Hudson Bay Capital Management, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Tamarack Capital Management allocated the biggest weight to Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL), around 7.87% of its 13F portfolio. Great Point Partners is also relatively very bullish on the stock, earmarking 1.37 percent of its 13F equity portfolio to RIGL.

As industrywide interest jumped, some big names have jumped into Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) headfirst. Great Point Partners, managed by Jeffrey Jay and David Kroin, created the most valuable position in Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL). Great Point Partners had $6.5 million invested in the company at the end of the quarter. Michael Castor’s Sio Capital also made a $3.6 million investment in the stock during the quarter. The following funds were also among the new RIGL investors: Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, David Rosen’s Rubric Capital Management, and Richard Driehaus’s Driehaus Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) but similarly valued. These stocks are Central Pacific Financial Corp. (NYSE:CPF), Antares Pharma Inc (NASDAQ:ATRS), New Senior Investment Group Inc (NYSE:SNR), Movado Group, Inc (NYSE:MOV), Calliditas Therapeutics AB (NASDAQ:CALT), Evelo Biosciences, Inc. (NASDAQ:EVLO), and X Financial (NYSE:XYF). This group of stocks’ market caps are similar to RIGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPF | 10 | 34533 | -3 |

| ATRS | 18 | 62450 | 1 |

| SNR | 18 | 95926 | 9 |

| MOV | 15 | 37263 | -2 |

| CALT | 4 | 29640 | -4 |

| EVLO | 6 | 4123 | 1 |

| XYF | 3 | 7411 | -1 |

| Average | 10.6 | 38764 | 0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.6 hedge funds with bullish positions and the average amount invested in these stocks was $39 million. That figure was $117 million in RIGL’s case. Antares Pharma Inc (NASDAQ:ATRS) is the most popular stock in this table. On the other hand X Financial (NYSE:XYF) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL) is more popular among hedge funds. Our overall hedge fund sentiment score for RIGL is 85.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Unfortunately RIGL wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on RIGL were disappointed as the stock returned -25.3% since the end of the second quarter (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Rigel Pharmaceuticals Inc (NASDAQ:RIGL)

Follow Rigel Pharmaceuticals Inc (NASDAQ:RIGL)

Receive real-time insider trading and news alerts

Suggested Articles:

- 20 Biggest One Hit Wonders of All Time

- 10 Best Dividend Paying Stocks to Buy Under $50

- 10 Reddit’s WallStreetBets Meme Stocks Hedge Funds are Piling Into

Disclosure: None. This article was originally published at Insider Monkey.