We have been waiting for this for a year and finally the third quarter ended up showing a nice bump in the performance of small-cap stocks. Both the S&P 500 and Russell 2000 were up since the end of the second quarter, but small-cap stocks outperformed the large-cap stocks by double digits. This is important for hedge funds, which are big supporters of small-cap stocks, because their investors started pulling some of their capital out due to poor recent performance. It is very likely that equity hedge funds will deliver better risk adjusted returns in the second half of this year. In this article we are going to look at how this recent market trend affected the sentiment of hedge funds towards Healthequity Inc (NASDAQ:HQY) , and what that likely means for the prospects of the company and its stock.

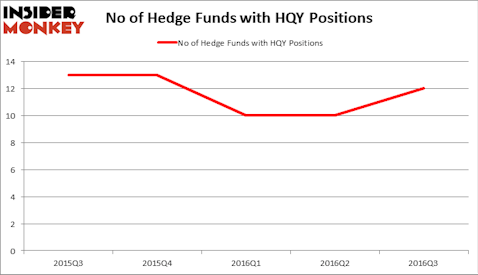

Is Healthequity Inc (NASDAQ:HQY) a bargain? Money managers are actually taking a bullish view. The number of bullish hedge fund investments inched up by 2 recently. HQY was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. There were 10 hedge funds in our database with HQY positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Watts Water Technologies Inc (NYSE:WTS), PBF Energy Inc (NYSE:PBF), and ABM Industries, Inc. (NYSE:ABM) to gather more data points.

Follow Healthequity Inc. (NASDAQ:HQY)

Follow Healthequity Inc. (NASDAQ:HQY)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Nataliia K/Shutterstock.com

How are hedge funds trading Healthequity Inc (NASDAQ:HQY)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HQY over the last 5 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Jim O’Brien and Jonathan Dorfman’s Napier Park Global Capital has the largest position in Healthequity Inc (NASDAQ:HQY), worth close to $25.6 million, accounting for 55.7% of its total 13F portfolio. The second largest stake is held by Royce & Associates, led by Chuck Royce, which holds a $7.6 million position. Some other professional money managers with similar optimism contain Seymour Sy Kaufman and Michael Stark’s Crosslink Capital and Richard Driehaus’ Driehaus Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, key money managers have been driving this bullishness. Adage Capital Management, led by Phill Gross and Robert Atchinson, initiated the most valuable position in Healthequity Inc (NASDAQ:HQY). Adage Capital Management had $6 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $2.5 million investment in the stock during the quarter. The following funds were also among the new HQY investors: Peter Muller’s PDT Partners, Ken Griffin’s Citadel Investment Group, and Paul Tudor Jones’ Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to Healthequity Inc (NASDAQ:HQY). These stocks are Watts Water Technologies Inc (NYSE:WTS), PBF Energy Inc (NYSE:PBF), ABM Industries, Inc. (NYSE:ABM), and Hilltop Holdings Inc. (NYSE:HTH). All of these stocks’ market caps are similar to HQY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WTS | 11 | 433841 | -2 |

| PBF | 23 | 497804 | -1 |

| ABM | 13 | 93533 | -2 |

| HTH | 15 | 34838 | 1 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $265 million. That figure was $56 million in HQY’s case. PBF Energy Inc (NYSE:PBF) is the most popular stock in this table. On the other hand Watts Water Technologies Inc (NYSE:WTS) is the least popular one with only 11 bullish hedge fund positions. Healthequity Inc (NASDAQ:HQY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PBF might be a better candidate to consider taking a long position in.

Disclosure: None