Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees during the first half of 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the second quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Getty Realty Corp. (NYSE:GTY).

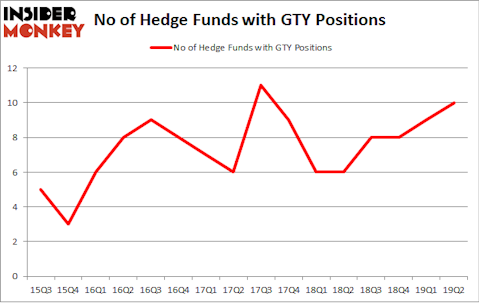

Is Getty Realty Corp. (NYSE:GTY) an exceptional investment right now? Prominent investors are becoming hopeful. The number of bullish hedge fund bets rose by 1 in recent months. Our calculations also showed that GTY isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the recent hedge fund action regarding Getty Realty Corp. (NYSE:GTY).

How are hedge funds trading Getty Realty Corp. (NYSE:GTY)?

At Q2’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from the first quarter of 2019. By comparison, 6 hedge funds held shares or bullish call options in GTY a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies holds the most valuable position in Getty Realty Corp. (NYSE:GTY). Renaissance Technologies has a $78.9 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is Millennium Management, managed by Israel Englander, which holds a $4.2 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other peers with similar optimism include Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management and John Overdeck and David Siegel’s Two Sigma Advisors.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Millennium Management, managed by Israel Englander, established the biggest position in Getty Realty Corp. (NYSE:GTY). Millennium Management had $4.2 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also initiated a $0.4 million position during the quarter. The other funds with brand new GTY positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Roger Ibbotson’s Zebra Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to Getty Realty Corp. (NYSE:GTY). These stocks are Victory Capital Holdings, Inc. (NASDAQ:VCTR), City Holding Company (NASDAQ:CHCO), Vicor Corporation (NASDAQ:VICR), and Avaya Holdings Corp. (NYSE:AVYA). This group of stocks’ market caps are closest to GTY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VCTR | 12 | 68237 | -1 |

| CHCO | 11 | 19024 | 3 |

| VICR | 13 | 20339 | 3 |

| AVYA | 42 | 309525 | 2 |

| Average | 19.5 | 104281 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $104 million. That figure was $93 million in GTY’s case. Avaya Holdings Corp. (NYSE:AVYA) is the most popular stock in this table. On the other hand City Holding Company (NASDAQ:CHCO) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Getty Realty Corp. (NYSE:GTY) is even less popular than CHCO. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on GTY, though not to the same extent, as the stock returned 5.4% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.