Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Burlington Stores Inc (NYSE:BURL) has seen an increase in enthusiasm from smart money in recent months. Our calculations also showed that burl isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are seen as slow, old financial tools of yesteryear. While there are more than 8,000 funds with their doors open today, Our experts hone in on the masters of this club, approximately 700 funds. These hedge fund managers control most of the smart money’s total asset base, and by watching their best stock picks, Insider Monkey has spotted various investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to review the fresh hedge fund action surrounding Burlington Stores Inc (NYSE:BURL).

What does the smart money think about Burlington Stores Inc (NYSE:BURL)?

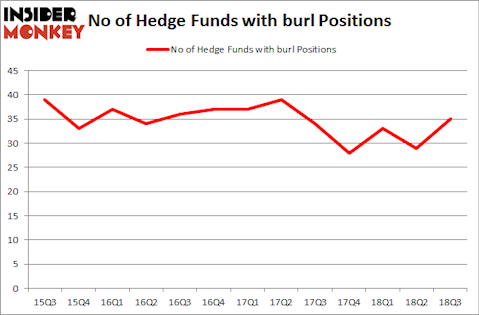

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 21% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BURL over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of Burlington Stores Inc (NYSE:BURL), with a stake worth $163 million reported as of the end of September. Trailing Adage Capital Management was Arrowstreet Capital, which amassed a stake valued at $147 million. Samlyn Capital, D E Shaw, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Junto Capital Management, managed by James Parsons, assembled the most valuable position in Burlington Stores Inc (NYSE:BURL). Junto Capital Management had $47 million invested in the company at the end of the quarter. Principal Global Investors’s Columbus Circle Investors also made a $16.4 million investment in the stock during the quarter. The following funds were also among the new BURL investors: Stanley Druckenmiller’s Duquesne Capital, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Burlington Stores Inc (NYSE:BURL). These stocks are Campbell Soup Company (NYSE:CPB), Extra Space Storage, Inc. (NYSE:EXR), Regency Centers Corp (NYSE:REG), and 58.com Inc (NYSE:WUBA). All of these stocks’ market caps are closest to BURL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPB | 29 | 925852 | 3 |

| EXR | 22 | 292795 | 5 |

| REG | 18 | 252505 | -4 |

| WUBA | 24 | 689789 | 2 |

| Average | 23.25 | 540235 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $540 million. That figure was $973 million in BURL’s case. Campbell Soup Company (NYSE:CPB) is the most popular stock in this table. On the other hand Regency Centers Corp (NYSE:REG) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Burlington Stores Inc (NYSE:BURL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.