We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Raymond James Financial, Inc. (NYSE:RJF).

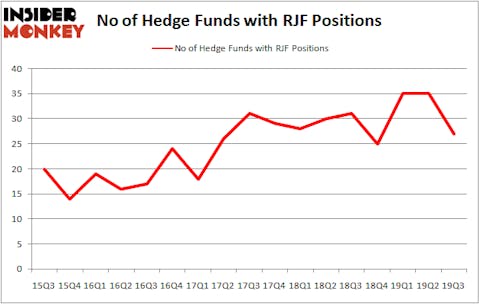

Raymond James Financial, Inc. (NYSE:RJF) has seen a decrease in support from the world’s most elite money managers lately. RJF was in 27 hedge funds’ portfolios at the end of September. There were 35 hedge funds in our database with RJF positions at the end of the previous quarter. Our calculations also showed that RJF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of indicators shareholders put to use to evaluate their holdings. A pair of the most under-the-radar indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite money managers can beat the S&P 500 by a solid amount (see the details here).

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the new hedge fund action surrounding Raymond James Financial, Inc. (NYSE:RJF).

Hedge fund activity in Raymond James Financial, Inc. (NYSE:RJF)

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in RJF over the last 17 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Raymond James Financial, Inc. (NYSE:RJF) was held by Brave Warrior Capital, which reported holding $212.3 million worth of stock at the end of September. It was followed by Eminence Capital with a $164.5 million position. Other investors bullish on the company included Fisher Asset Management, Millennium Management, and RR Partners. In terms of the portfolio weights assigned to each position Brave Warrior Capital allocated the biggest weight to Raymond James Financial, Inc. (NYSE:RJF), around 11.33% of its portfolio. RR Partners is also relatively very bullish on the stock, designating 5.86 percent of its 13F equity portfolio to RJF.

Since Raymond James Financial, Inc. (NYSE:RJF) has witnessed declining sentiment from hedge fund managers, we can see that there were a few funds that decided to sell off their full holdings by the end of the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management cut the biggest investment of all the hedgies followed by Insider Monkey, totaling close to $79.2 million in stock. Daniel Johnson’s fund, Gillson Capital, also said goodbye to its stock, about $12.2 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 8 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Raymond James Financial, Inc. (NYSE:RJF). These stocks are Arconic Inc. (NYSE:ARNC), Yandex NV (NASDAQ:YNDX), FMC Corporation (NYSE:FMC), and InterContinental Hotels Group PLC (NYSE:IHG). All of these stocks’ market caps resemble RJF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARNC | 34 | 3136590 | -8 |

| YNDX | 35 | 809543 | 5 |

| FMC | 36 | 788705 | 0 |

| IHG | 7 | 29788 | 3 |

| Average | 28 | 1191157 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1191 million. That figure was $793 million in RJF’s case. FMC Corporation (NYSE:FMC) is the most popular stock in this table. On the other hand InterContinental Hotels Group PLC (NYSE:IHG) is the least popular one with only 7 bullish hedge fund positions. Raymond James Financial, Inc. (NYSE:RJF) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on RJF, though not to the same extent, as the stock returned 8.9% during the first two months of the fourth quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.