We are still in an overall bull market and many stocks that smart money investors were piling into surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Hedge funds’ top 3 stock picks returned 39.1% this year and beat the S&P 500 ETFs by nearly 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like The Bank of New York Mellon Corporation (NYSE:BK).

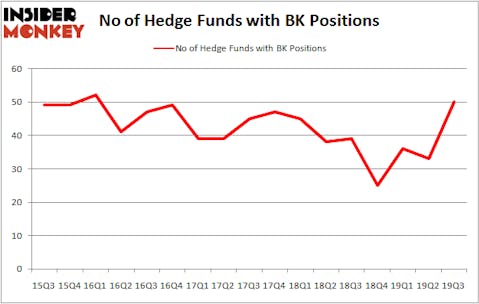

Is The Bank of New York Mellon Corporation (NYSE:BK) a buy here? The best stock pickers are betting on the stock. The number of bullish hedge fund positions improved by 17 lately. Our calculations also showed that BK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the recent hedge fund action surrounding The Bank of New York Mellon Corporation (NYSE:BK).

How are hedge funds trading The Bank of New York Mellon Corporation (NYSE:BK)?

Heading into the fourth quarter of 2019, a total of 50 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 52% from the previous quarter. By comparison, 39 hedge funds held shares or bullish call options in BK a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in The Bank of New York Mellon Corporation (NYSE:BK) was held by Berkshire Hathaway, which reported holding $3659.2 million worth of stock at the end of September. It was followed by Trian Partners with a $549.5 million position. Other investors bullish on the company included Citadel Investment Group, Yacktman Asset Management, and GAMCO Investors. In terms of the portfolio weights assigned to each position Trian Partners allocated the biggest weight to The Bank of New York Mellon Corporation (NYSE:BK), around 5.74% of its portfolio. Junto Capital Management is also relatively very bullish on the stock, designating 3.55 percent of its 13F equity portfolio to BK.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Junto Capital Management, managed by James Parsons, created the most outsized position in The Bank of New York Mellon Corporation (NYSE:BK). Junto Capital Management had $59.7 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also initiated a $53.5 million position during the quarter. The following funds were also among the new BK investors: Steve Cohen’s Point72 Asset Management, Daniel Johnson’s Gillson Capital, and Anand Parekh’s Alyeska Investment Group.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as The Bank of New York Mellon Corporation (NYSE:BK) but similarly valued. We will take a look at ABB Ltd (NYSE:ABB), Koninklijke Philips NV (NYSE:PHG), UBS Group AG (NYSE:UBS), and Orange S.A. (NYSE:ORAN). All of these stocks’ market caps resemble BK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ABB | 13 | 325803 | 0 |

| PHG | 7 | 173329 | -1 |

| UBS | 16 | 816881 | 2 |

| ORAN | 3 | 2104 | 1 |

| Average | 9.75 | 329529 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $330 million. That figure was $5639 million in BK’s case. UBS Group AG (NYSE:UBS) is the most popular stock in this table. On the other hand Orange S.A. (NYSE:ORAN) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks The Bank of New York Mellon Corporation (NYSE:BK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on BK as the stock returned 8.7% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.