At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

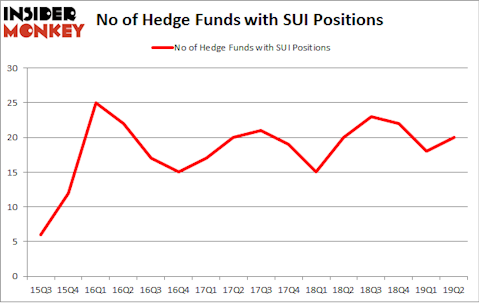

Sun Communities Inc (NYSE:SUI) was in 20 hedge funds’ portfolios at the end of the second quarter of 2019. SUI has experienced an increase in activity from the world’s largest hedge funds of late. There were 18 hedge funds in our database with SUI positions at the end of the previous quarter. Our calculations also showed that SUI isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a peek at the recent hedge fund action encompassing Sun Communities Inc (NYSE:SUI).

Hedge fund activity in Sun Communities Inc (NYSE:SUI)

At Q2’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SUI over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Citadel Investment Group, managed by Ken Griffin, holds the number one position in Sun Communities Inc (NYSE:SUI). Citadel Investment Group has a $120.1 million position in the stock, comprising 0.1% of its 13F portfolio. The second Renaissance Technologies, with a $97.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that are bullish encompass Israel Englander’s Millennium Management, Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors and Greg Poole’s Echo Street Capital Management.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Element Capital Management, managed by Jeffrey Talpins, created the most valuable position in Sun Communities Inc (NYSE:SUI). Element Capital Management had $32.2 million invested in the company at the end of the quarter. Louis Navellier’s Navellier & Associates also made a $2.8 million investment in the stock during the quarter. The following funds were also among the new SUI investors: Jaime Sterne’s Skye Global Management, Mario Gabelli’s GAMCO Investors, and Matthew Tewksbury’s Stevens Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Sun Communities Inc (NYSE:SUI) but similarly valued. We will take a look at Raymond James Financial, Inc. (NYSE:RJF), PG&E Corporation (NYSE:PCG), ABIOMED, Inc. (NASDAQ:ABMD), and Nomura Holdings, Inc. (NYSE:NMR). This group of stocks’ market values are similar to SUI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RJF | 35 | 764230 | 0 |

| PCG | 67 | 6316603 | -5 |

| ABMD | 28 | 1005300 | -5 |

| NMR | 7 | 23320 | 2 |

| Average | 34.25 | 2027363 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $2027 million. That figure was $429 million in SUI’s case. PG&E Corporation (NYSE:PCG) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (NYSE:NMR) is the least popular one with only 7 bullish hedge fund positions. Sun Communities Inc (NYSE:SUI) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks (see the video below) among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on SUI as the stock returned 16.4% during the same time frame and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.