With the third-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the fourth quarter. One of these stocks was China Telecom Corporation Limited (NYSE:CHA).

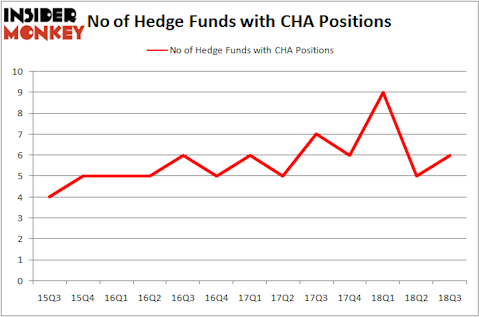

China Telecom Corporation Limited (NYSE:CHA) was in 6 hedge funds’ portfolios at the end of the third quarter of 2018. CHA investors should pay attention to an increase in hedge fund interest of late. There were 5 hedge funds in our database with CHA holdings at the end of the previous quarter. Our calculations also showed that CHA isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action surrounding China Telecom Corporation Limited (NYSE:CHA).

What have hedge funds been doing with China Telecom Corporation Limited (NYSE:CHA)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CHA over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of China Telecom Corporation Limited (NYSE:CHA), with a stake worth $10.4 million reported as of the end of September. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $7.5 million. Two Sigma Advisors, Millennium Management, and Sensato Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key money managers have jumped into China Telecom Corporation Limited (NYSE:CHA) headfirst. Sensato Capital Management, managed by Ernest Chow and Jonathan Howe, created the most outsized position in China Telecom Corporation Limited (NYSE:CHA). Sensato Capital Management had $0.3 million invested in the company at the end of the quarter.

Let’s go over hedge fund activity in other stocks similar to China Telecom Corporation Limited (NYSE:CHA). These stocks are Delta Air Lines, Inc. (NYSE:DAL), LyondellBasell Industries NV (NYSE:LYB), Canadian Natural Resources Limited (NYSE:CNQ), and Kimberly Clark Corporation (NYSE:KMB). This group of stocks’ market valuations are closest to CHA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DAL | 67 | 7548095 | 1 |

| LYB | 39 | 2384054 | 0 |

| CNQ | 23 | 577380 | 0 |

| KMB | 26 | 566707 | -1 |

| Average | 38.75 | 2769059 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.75 hedge funds with bullish positions and the average amount invested in these stocks was $2.77 billion. That figure was $22 million in CHA’s case. Delta Air Lines, Inc. (NYSE:DAL) is the most popular stock in this table. On the other hand Canadian Natural Resources Limited (NYSE:CNQ) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks China Telecom Corporation Limited (NYSE:CHA) is even less popular than CNQ. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.