Is Trinity Industries, Inc. (NYSE:TRN) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

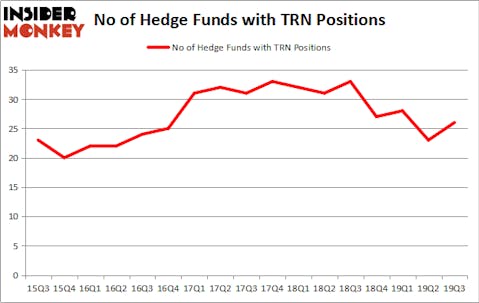

Is Trinity Industries, Inc. (NYSE:TRN) a worthy stock to buy now? The best stock pickers are getting more optimistic. The number of long hedge fund bets went up by 3 lately. Our calculations also showed that TRN isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a large number of gauges market participants use to assess their holdings. A couple of the most underrated gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outpace their index-focused peers by a solid amount (see the details here).

Jeffrey Ubben of ValueAct Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the new hedge fund action regarding Trinity Industries, Inc. (NYSE:TRN).

How have hedgies been trading Trinity Industries, Inc. (NYSE:TRN)?

Heading into the fourth quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from the previous quarter. By comparison, 33 hedge funds held shares or bullish call options in TRN a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, ValueAct Capital, managed by Jeffrey Ubben, holds the largest position in Trinity Industries, Inc. (NYSE:TRN). ValueAct Capital has a $444 million position in the stock, comprising 4.8% of its 13F portfolio. Coming in second is Leon Cooperman of Omega Advisors, with a $55.9 million position; 3.3% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish contain David E. Shaw’s D E Shaw, Brian Gootzeit and Andrew Frank’s StackLine Partners and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position StackLine Partners allocated the biggest weight to Trinity Industries, Inc. (NYSE:TRN), around 11.12% of its portfolio. ValueAct Capital is also relatively very bullish on the stock, dishing out 4.79 percent of its 13F equity portfolio to TRN.

As aggregate interest increased, some big names have jumped into Trinity Industries, Inc. (NYSE:TRN) headfirst. PEAK6 Capital Management, managed by Matthew Hulsizer, assembled the most valuable call position in Trinity Industries, Inc. (NYSE:TRN). PEAK6 Capital Management had $2.3 million invested in the company at the end of the quarter. Robert Bishop’s Impala Asset Management also initiated a $1 million position during the quarter. The other funds with brand new TRN positions are Steve Cohen’s Point72 Asset Management, Michael Gelband’s ExodusPoint Capital, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Trinity Industries, Inc. (NYSE:TRN) but similarly valued. We will take a look at BridgeBio Pharma, Inc. (NASDAQ:BBIO), PolyOne Corporation (NYSE:POL), Kosmos Energy Ltd (NYSE:KOS), and Golub Capital BDC Inc (NASDAQ:GBDC). This group of stocks’ market caps are closest to TRN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BBIO | 12 | 884584 | -2 |

| POL | 19 | 176335 | -5 |

| KOS | 24 | 154461 | 0 |

| GBDC | 11 | 47351 | 3 |

| Average | 16.5 | 315683 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $316 million. That figure was $680 million in TRN’s case. Kosmos Energy Ltd (NYSE:KOS) is the most popular stock in this table. On the other hand Golub Capital BDC Inc (NASDAQ:GBDC) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Trinity Industries, Inc. (NYSE:TRN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on TRN, though not to the same extent, as the stock returned 8% during the fourth quarter (through the end of November) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.