The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Prospect Capital Corporation (NASDAQ:PSEC).

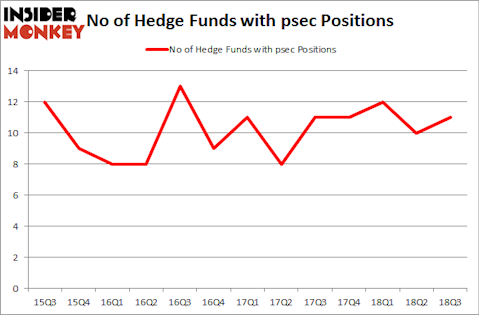

Prospect Capital Corporation (NASDAQ:PSEC) has experienced an increase in hedge fund interest of late. PSEC was in 11 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with PSEC holdings at the end of the previous quarter. Our calculations also showed that psec isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action regarding Prospect Capital Corporation (NASDAQ:PSEC).

What have hedge funds been doing with Prospect Capital Corporation (NASDAQ:PSEC)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PSEC over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of Prospect Capital Corporation (NASDAQ:PSEC), with a stake worth $18.4 million reported as of the end of September. Trailing Arrowstreet Capital was Millennium Management, which amassed a stake valued at $7.5 million. McKinley Capital Management, Two Sigma Advisors, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Prospect Capital Corporation (NASDAQ:PSEC). Arrowstreet Capital had $18.4 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $0.2 million position during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Prospect Capital Corporation (NASDAQ:PSEC). These stocks are QEP Resources Inc (NYSE:QEP), Retail Properties of America Inc (NYSE:RPAI), Cloudera, Inc. (NYSE:CLDR), and Integer Holdings Corporation (NYSE:ITGR). All of these stocks’ market caps are similar to PSEC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QEP | 22 | 466803 | 3 |

| RPAI | 14 | 244414 | -3 |

| CLDR | 25 | 113418 | 12 |

| ITGR | 17 | 247639 | -5 |

| Average | 19.5 | 268069 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.5 hedge funds with bullish positions and the average amount invested in these stocks was $268 million. That figure was $47 million in PSEC’s case. Cloudera, Inc. (NYSE:CLDR) is the most popular stock in this table. On the other hand Retail Properties of America Inc (NYSE:RPAI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Prospect Capital Corporation (NASDAQ:PSEC) is even less popular than RPAI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.