“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. That’s why we believe it would be worthwhile to take a look at the hedge fund sentiment on Applied Materials, Inc. (NASDAQ:AMAT) in order to identify whether reputable and successful top money managers continue to believe in its potential.

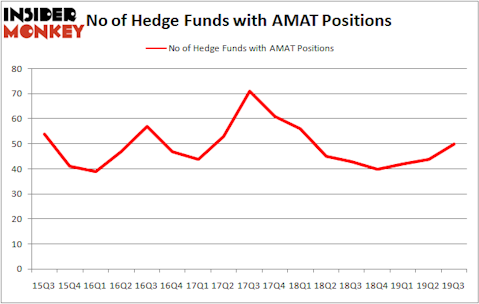

Applied Materials, Inc. (NASDAQ:AMAT) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. AMAT was in 50 hedge funds’ portfolios at the end of September. There were 44 hedge funds in our database with AMAT holdings at the end of the previous quarter. Our calculations also showed that AMAT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a lot of signals shareholders have at their disposal to size up publicly traded companies. A couple of the most useful signals are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best fund managers can outpace the S&P 500 by a superb amount (see the details here).

Let’s take a glance at the key hedge fund action surrounding Applied Materials, Inc. (NASDAQ:AMAT).

How have hedgies been trading Applied Materials, Inc. (NASDAQ:AMAT)?

At Q3’s end, a total of 50 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 43 hedge funds with a bullish position in AMAT a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the biggest position in Applied Materials, Inc. (NASDAQ:AMAT), worth close to $468.1 million, comprising 0.6% of its total 13F portfolio. On AQR Capital Management’s heels is Generation Investment Management, led by David Blood and Al Gore, holding a $229.6 million position; the fund has 1.6% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of David Goel and Paul Ferri’s Matrix Capital Management, Alex Snow’s Lansdowne Partners and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to Applied Materials, Inc. (NASDAQ:AMAT), around 13.85% of its portfolio. Praesidium Investment Management is also relatively very bullish on the stock, earmarking 5.47 percent of its 13F equity portfolio to AMAT.

With a general bullishness amongst the heavyweights, some big names have jumped into Applied Materials, Inc. (NASDAQ:AMAT) headfirst. Hitchwood Capital Management, managed by James Crichton, established the most outsized position in Applied Materials, Inc. (NASDAQ:AMAT). Hitchwood Capital Management had $54.9 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $49.2 million position during the quarter. The other funds with brand new AMAT positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Dmitry Balyasny’s Balyasny Asset Management, and Leon Shaulov’s Maplelane Capital.

Let’s also examine hedge fund activity in other stocks similar to Applied Materials, Inc. (NASDAQ:AMAT). These stocks are Relx PLC (NYSE:RELX), Phillips 66 (NYSE:PSX), Honda Motor Co Ltd (NYSE:HMC), and Edwards Lifesciences Corporation (NYSE:EW). All of these stocks’ market caps are closest to AMAT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RELX | 6 | 105678 | 3 |

| PSX | 36 | 1315132 | -3 |

| HMC | 10 | 129921 | 3 |

| EW | 34 | 1384665 | 1 |

| Average | 21.5 | 733849 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $734 million. That figure was $2356 million in AMAT’s case. Phillips 66 (NYSE:PSX) is the most popular stock in this table. On the other hand Relx PLC (NYSE:RELX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Applied Materials, Inc. (NASDAQ:AMAT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on AMAT as the stock returned 12.5% during Q4 (through 11/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.