Hedge funds started to disclose their holdings at the end of 2019 in new 13F filings. They have 45 days from the end of each quarter to disclose their positions in publicly traded US stocks, options, and convertible debt. Insider Monkey tracks more than 750 hedge funds and usually more than half of these hedge funds will wait until the last day to file their 13Fs with the SEC. Fortunately, our experience shows that aggregate hedge fund sentiment towards most stocks don’t change much. In this article we are going to take a look at how hedge funds have been feeling about a stock like Visa Inc and compare its performance against similarly valued stocks like JPMorgan Chase & Co. (NYSE:JPM), Johnson & Johnson (NYSE:JNJ), Walmart Inc. (NYSE:WMT), and Nestle SA (OTCMKTS:NSRGY).

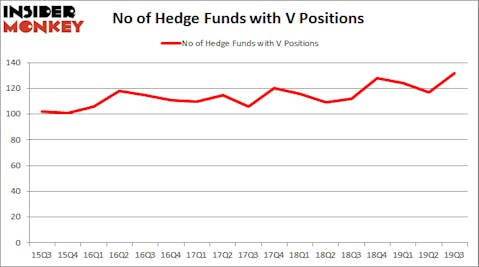

Visa Inc (NYSE:V) investors should be aware of an increase in hedge fund interest recently. V was in 132 hedge funds’ portfolios at the end of the third quarter of 2019. There were 117 hedge funds in our database with V holdings at the end of the previous quarter. Our calculations also showed that V consistently ranked near the top of our quarterly rankings of the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that historically hedge funds’ stock picks outperformed the market by a large margin. That’s why hedge fund industry became a $3 trillion industry. However, you can’t outperform the market by replicating the entire portfolio of an average hedge fund anymore. Luckily Insider Monkey came up with proprietary algorithms to identify the best stock picks of the best hedge fund managers. We have been sharing a portfolio of around 15 hand picked stocks in our monthly newsletter since March 2017 and generated a cumulative return of 87% vs. 47.7% S&P 500 ETFs during the same period (see the details here).

We leave no stone unturned when looking for the next great investment idea. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap trading at an enterprise value/operating profit ratio of 1 (this isn’t a typo). In January, we recommended a position in a dividend stock with a PE ratio of less than 7 that is growing its earnings and yields 11%.

JMiks / Shutterstock.com

Now we’re going to take a look at the recent hedge fund action surrounding Visa Inc (NYSE:V).

How are hedge funds trading Visa Inc (NYSE:V)?

At Q3’s end, a total of 132 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from the second quarter of 2019. By comparison, 112 hedge funds held shares or bullish call options in V a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Visa Inc (NYSE:V) was held by Fisher Asset Management, which reported holding $3474.7 million worth of stock at the end of September. It was followed by Berkshire Hathaway with a $1816.8 million position. Other investors bullish on the company included Arrowstreet Capital, Akre Capital Management, and D E Shaw. In terms of the portfolio weights assigned to each position Hengistbury Investment Partners allocated the biggest weight to Visa Inc (NYSE:V), around 45.26% of its 13F portfolio. Valley Forge Capital is also relatively very bullish on the stock, designating 18.54 percent of its 13F equity portfolio to V.

As aggregate interest increased, key hedge funds have been driving this bullishness. Millennium Management, managed by Israel Englander, created the largest call position in Visa Inc (NYSE:V). Millennium Management had $61 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $49.5 million position during the quarter. The following funds were also among the new V investors: Bo Shan’s Gobi Capital, Glen Kacher’s Light Street Capital, and Christopher James’s Partner Fund Management.

Let’s now review hedge fund activity in other stocks similar to Visa Inc (NYSE:V). We will take a look at JPMorgan Chase & Co. (NYSE:JPM), Johnson & Johnson (NYSE:JNJ), Walmart Inc. (NYSE:WMT), and Nestle SA (OTCMKTS:NSRGY). This group of stocks’ market values resemble V’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JPM | 84 | 11167465 | -6 |

| JNJ | 76 | 7326703 | 13 |

| WMT | 56 | 5584105 | 0 |

| NSRGY | 4 | 1831756 | 0 |

| Average | 55 | 6477507 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 55 hedge funds with bullish positions and the average amount invested in these stocks was $6478 million. That figure was $15686 million in V’s case. JPMorgan Chase & Co. (NYSE:JPM) is the most popular stock in this table. On the other hand Nestle SA (OTCMKTS:NSRGY) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Visa Inc (NYSE:V) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These top 20 hedge fund stocks also returned 4.5% so far in 2020 and beat the market by an additional 3 percentage points. Hedge funds were also right about betting on V as the stock returned 9% in 2020 and outperformed the market by an even larger margin. JP Morgan and Walmart had negative returns in 2020, whereas JNJ’s 3% gain didn’t come close to Visa’s year-to-date return.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.