Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Lithia Motors Inc (NYSE:LAD) and compare its performance to hedge funds’ consensus picks in 2019.

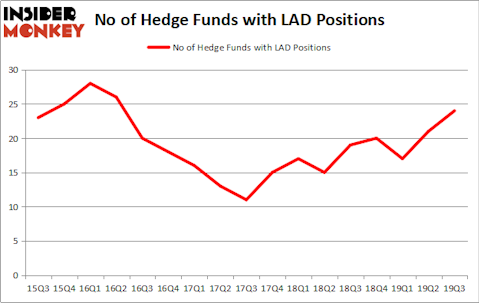

Lithia Motors Inc (NYSE:LAD) investors should be aware of an increase in support from the world’s most elite money managers of late. LAD was in 24 hedge funds’ portfolios at the end of the third quarter of 2019. There were 21 hedge funds in our database with LAD holdings at the end of the previous quarter. Our calculations also showed that LAD isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Ken Heebner of Capital Growth Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to check out the key hedge fund action regarding Lithia Motors Inc (NYSE:LAD).

What does smart money think about Lithia Motors Inc (NYSE:LAD)?

Heading into the fourth quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in LAD a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Abrams Capital Management held the most valuable stake in Lithia Motors Inc (NYSE:LAD), which was worth $304.5 million at the end of the third quarter. On the second spot was Cardinal Capital which amassed $100.3 million worth of shares. Arrowstreet Capital, Capital Growth Management, and GLG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Abrams Capital Management allocated the biggest weight to Lithia Motors Inc (NYSE:LAD), around 8.52% of its 13F portfolio. Cardinal Capital is also relatively very bullish on the stock, setting aside 3.31 percent of its 13F equity portfolio to LAD.

As industrywide interest jumped, some big names have jumped into Lithia Motors Inc (NYSE:LAD) headfirst. Capital Growth Management, managed by Ken Heebner, created the most outsized position in Lithia Motors Inc (NYSE:LAD). Capital Growth Management had $40.1 million invested in the company at the end of the quarter. Renaissance Technologies also made a $3.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Charles Davidson and Joseph Jacobs’s Wexford Capital, Cliff Asness’s AQR Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Lithia Motors Inc (NYSE:LAD) but similarly valued. These stocks are Grocery Outlet Holding Corp. (NASDAQ:GO), Mirati Therapeutics, Inc. (NASDAQ:MRTX), Atlantic Union Bankshares Corporation (NASDAQ:AUB), and NuStar Energy L.P. (NYSE:NS). This group of stocks’ market valuations are similar to LAD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GO | 15 | 63095 | -6 |

| MRTX | 33 | 1154565 | 6 |

| AUB | 3 | 19925 | 0 |

| NS | 2 | 1883 | 0 |

| Average | 13.25 | 309867 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $310 million. That figure was $629 million in LAD’s case. Mirati Therapeutics, Inc. (NASDAQ:MRTX) is the most popular stock in this table. On the other hand NuStar Energy L.P. (NYSE:NS) is the least popular one with only 2 bullish hedge fund positions. Lithia Motors Inc (NYSE:LAD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on LAD as the stock returned 94.6% in 2019 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.