Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

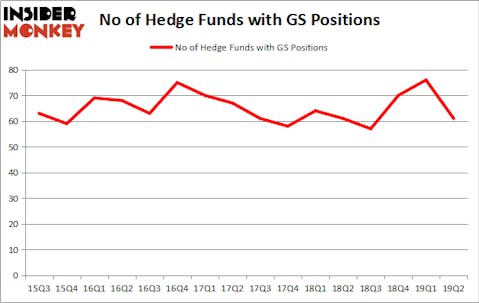

Is Goldman Sachs Group, Inc. (NYSE:GS) the right pick for your portfolio? Hedge funds are reducing their bets on the stock. The number of bullish hedge fund positions fell by 15 in recent months though overall hedge fund sentiment is still quite bullish, just not as bullish as before. Our calculations also showed that GS isn’t among the 30 most popular stocks among hedge funds (see the video below). GS was in 61 hedge funds’ portfolios at the end of the second quarter of 2019. There were 76 hedge funds in our database with GS holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the new hedge fund action regarding Goldman Sachs Group, Inc. (NYSE:GS).

What does smart money think about Goldman Sachs Group, Inc. (NYSE:GS)?

At the end of the second quarter, a total of 61 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in GS over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of Goldman Sachs Group, Inc. (NYSE:GS), with a stake worth $3755.2 million reported as of the end of March. Trailing Berkshire Hathaway was Eagle Capital Management, which amassed a stake valued at $1417.3 million. Greenhaven Associates, Citadel Investment Group, and Pzena Investment Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Goldman Sachs Group, Inc. (NYSE:GS) has experienced a decline in interest from the smart money, logic holds that there were a few hedge funds that slashed their positions entirely heading into Q3. Intriguingly, Steven Tananbaum’s GoldenTree Asset Management dropped the largest investment of all the hedgies followed by Insider Monkey, worth an estimated $41.9 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund said goodbye to about $15.9 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 15 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Goldman Sachs Group, Inc. (NYSE:GS) but similarly valued. These stocks are Uber Technologies, Inc. (NYSE:UBER), Banco Santander, S.A. (NYSE:SAN), Ambev SA (NYSE:ABEV), and Morgan Stanley (NYSE:MS). This group of stocks’ market values resemble GS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBER | 56 | 5766639 | 56 |

| SAN | 22 | 701860 | -1 |

| ABEV | 16 | 294772 | 3 |

| MS | 60 | 4267216 | 6 |

| Average | 38.5 | 2757622 | 16 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.5 hedge funds with bullish positions and the average amount invested in these stocks was $2758 million. That figure was $8201 million in GS’s case. Morgan Stanley (NYSE:MS) is the most popular stock in this table. On the other hand Ambev SA (NYSE:ABEV) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Goldman Sachs Group, Inc. (NYSE:GS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on GS, though not to the same extent, as the stock returned 1.9% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.