It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of 4 percentage points during the first 9 months of 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Global Indemnity Limited (NASDAQ:GBLI).

Hedge fund interest in Global Indemnity Limited (NASDAQ:GBLI) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare GBLI to other stocks including PAR Technology Corporation (NYSE:PAR), Azure Power Global Limited (NYSE:AZRE), and PCM, Inc. (NASDAQ:PCMI) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a multitude of indicators market participants use to size up publicly traded companies. A duo of the less utilized indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce the S&P 500 by a significant margin (see the details here).

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. Let’s check out the latest hedge fund action encompassing Global Indemnity Limited (NASDAQ:GBLI).

What have hedge funds been doing with Global Indemnity Limited (NASDAQ:GBLI)?

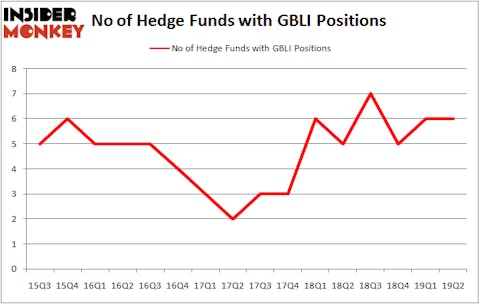

At the end of the second quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GBLI over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Brian Gaines’s Springhouse Capital Management has the most valuable position in Global Indemnity Limited (NASDAQ:GBLI), worth close to $23.2 million, corresponding to 13% of its total 13F portfolio. The second most bullish fund manager is Capital Returns Management, managed by Ron Bobman, which holds a $6.3 million position; 3.6% of its 13F portfolio is allocated to the company. Some other peers that are bullish encompass Renaissance Technologies, Jeffrey Bronchick’s Cove Street Capital and Ken Griffin’s Citadel Investment Group.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Diamond Hill Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Springbok Capital).

Let’s check out hedge fund activity in other stocks similar to Global Indemnity Limited (NASDAQ:GBLI). These stocks are PAR Technology Corporation (NYSE:PAR), Azure Power Global Limited (NYSE:AZRE), PCM, Inc. (NASDAQ:PCMI), and Oxford Lane Capital Corp. (NASDAQ:OXLC). All of these stocks’ market caps are similar to GBLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAR | 5 | 31863 | -1 |

| AZRE | 6 | 9530 | 0 |

| PCMI | 10 | 23013 | -7 |

| OXLC | 3 | 1694 | 2 |

| Average | 6 | 16525 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $35 million in GBLI’s case. PCM, Inc. (NASDAQ:PCMI) is the most popular stock in this table. On the other hand Oxford Lane Capital Corp. (NASDAQ:OXLC) is the least popular one with only 3 bullish hedge fund positions. Global Indemnity Limited (NASDAQ:GBLI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately GBLI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); GBLI investors were disappointed as the stock returned -18.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.