The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Zymeworks Inc. (NYSE:ZYME).

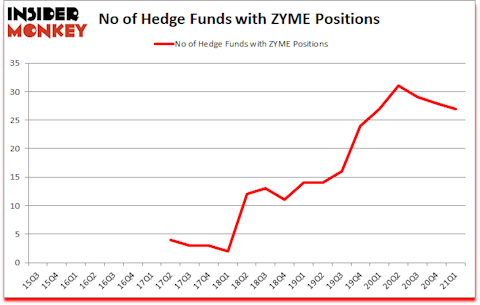

Zymeworks Inc. (NYSE:ZYME) investors should be aware of a decrease in activity from the world’s largest hedge funds lately. Zymeworks Inc. (NYSE:ZYME) was in 27 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 31. There were 28 hedge funds in our database with ZYME holdings at the end of December. Our calculations also showed that ZYME isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

Today there are several tools stock market investors can use to value their stock investments. A couple of the less known tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the best money managers can beat the S&P 500 by a very impressive margin (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Ryan Tolkin, CIO of Schonfeld Strategic Advisors

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, economists warn of inflation flare up. So, we are checking out this backdoor gold play that has hit peak gains of 718% in a little over a year. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a look at the fresh hedge fund action regarding Zymeworks Inc. (NYSE:ZYME).

Do Hedge Funds Think ZYME Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the previous quarter. On the other hand, there were a total of 27 hedge funds with a bullish position in ZYME a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Perceptive Advisors was the largest shareholder of Zymeworks Inc. (NYSE:ZYME), with a stake worth $136.8 million reported as of the end of March. Trailing Perceptive Advisors was Cormorant Asset Management, which amassed a stake valued at $63.2 million. Baker Bros. Advisors, Armistice Capital, and Redmile Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 0 allocated the biggest weight to Zymeworks Inc. (NYSE:ZYME), around 1.73% of its 13F portfolio. 0 is also relatively very bullish on the stock, setting aside 1.41 percent of its 13F equity portfolio to ZYME.

Seeing as Zymeworks Inc. (NYSE:ZYME) has experienced falling interest from the smart money, it’s easy to see that there lies a certain “tier” of money managers that elected to cut their entire stakes heading into Q2. It’s worth mentioning that Jeffrey Jay and David Kroin’s Great Point Partners dumped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, worth close to $37.8 million in stock, and OrbiMed Advisors was right behind this move, as the fund sold off about $15 million worth. These moves are interesting, as aggregate hedge fund interest fell by 1 funds heading into Q2.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Zymeworks Inc. (NYSE:ZYME) but similarly valued. We will take a look at Star Bulk Carriers Corp. (NASDAQ:SBLK), Arco Platform Limited (NASDAQ:ARCE), Archrock, Inc. (NYSE:AROC), Regenxbio Inc (NASDAQ:RGNX), Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT), Franchise Group, Inc. (NASDAQ:FRG), and Textainer Group Holdings Limited (NYSE:TGH). This group of stocks’ market caps resemble ZYME’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBLK | 13 | 692200 | 3 |

| ARCE | 8 | 49651 | -7 |

| AROC | 16 | 46620 | 5 |

| RGNX | 22 | 208915 | 1 |

| ARQT | 14 | 610080 | 1 |

| FRG | 17 | 95715 | 3 |

| TGH | 14 | 46267 | 3 |

| Average | 14.9 | 249921 | 1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.9 hedge funds with bullish positions and the average amount invested in these stocks was $250 million. That figure was $474 million in ZYME’s case. Regenxbio Inc (NASDAQ:RGNX) is the most popular stock in this table. On the other hand Arco Platform Limited (NASDAQ:ARCE) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Zymeworks Inc. (NYSE:ZYME) is more popular among hedge funds. Our overall hedge fund sentiment score for ZYME is 80.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through July 9th and still managed to beat the market by 6.7 percentage points. Hedge funds were also right about betting on ZYME, though not to the same extent, as the stock returned 16.7% since the end of March (through July 9th) and outperformed the market as well.

Follow Zymeworks Bc Inc. (NASDAQ:ZYME)

Follow Zymeworks Bc Inc. (NASDAQ:ZYME)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 15 Largest Energy Companies

- 25 Biggest Questions In Science

Disclosure: None. This article was originally published at Insider Monkey.