The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 28. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Illumina, Inc. (NASDAQ:ILMN).

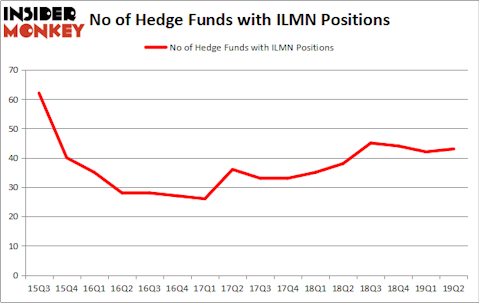

Is Illumina, Inc. (NASDAQ:ILMN) a first-rate stock to buy now? Money managers are becoming more confident. The number of bullish hedge fund bets increased by 1 in recent months. Our calculations also showed that ILMN isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are viewed as slow, old investment tools of years past. While there are greater than 8000 funds in operation at present, Our researchers choose to focus on the bigwigs of this club, about 750 funds. Most estimates calculate that this group of people orchestrate the lion’s share of the smart money’s total capital, and by keeping track of their best stock picks, Insider Monkey has unsheathed several investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the new hedge fund action regarding Illumina, Inc. (NASDAQ:ILMN).

What does smart money think about Illumina, Inc. (NASDAQ:ILMN)?

At Q2’s end, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 2% from one quarter earlier. On the other hand, there were a total of 38 hedge funds with a bullish position in ILMN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Viking Global, managed by Andreas Halvorsen, holds the biggest position in Illumina, Inc. (NASDAQ:ILMN). Viking Global has a $504.8 million position in the stock, comprising 2.3% of its 13F portfolio. Sitting at the No. 2 spot is Citadel Investment Group, managed by Ken Griffin, which holds a $119.7 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish contain James Crichton’s Hitchwood Capital Management, Cliff Asness’s AQR Capital Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. QVT Financial, managed by Daniel Gold, assembled the most outsized call position in Illumina, Inc. (NASDAQ:ILMN). QVT Financial had $22.1 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also initiated a $12.9 million position during the quarter. The following funds were also among the new ILMN investors: Israel Englander’s Millennium Management, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now take a look at hedge fund activity in other stocks similar to Illumina, Inc. (NASDAQ:ILMN). These stocks are Schlumberger Limited. (NYSE:SLB), Charles Schwab Corp (NYSE:SCHW), ServiceNow Inc (NYSE:NOW), and Norfolk Southern Corp. (NYSE:NSC). All of these stocks’ market caps are similar to ILMN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLB | 41 | 1851257 | -8 |

| SCHW | 48 | 2698349 | -3 |

| NOW | 77 | 4250893 | 12 |

| NSC | 54 | 2126444 | 7 |

| Average | 55 | 2731736 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 55 hedge funds with bullish positions and the average amount invested in these stocks was $2732 million. That figure was $1354 million in ILMN’s case. ServiceNow Inc (NYSE:NOW) is the most popular stock in this table. On the other hand Schlumberger Limited. (NYSE:SLB) is the least popular one with only 41 bullish hedge fund positions. Illumina, Inc. (NASDAQ:ILMN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ILMN wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ILMN investors were disappointed as the stock returned -17.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.