Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of ASGN Incorporated (NYSE:ASGN) based on that data and determine whether they were really smart about the stock.

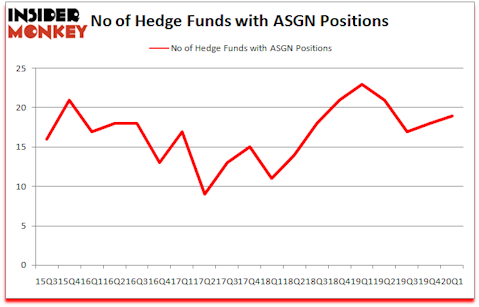

Is ASGN Incorporated (NYSE:ASGN) a great investment today? Hedge funds were taking an optimistic view. The number of bullish hedge fund positions rose by 1 in recent months. Our calculations also showed that ASGN isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). ASGN was in 19 hedge funds’ portfolios at the end of the first quarter of 2020. There were 18 hedge funds in our database with ASGN positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Cannabis stocks are roaring back in 2020, so we are checking out this under-the-radar stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Keeping this in mind we’re going to view the key hedge fund action surrounding ASGN Incorporated (NYSE:ASGN).

How are hedge funds trading ASGN Incorporated (NYSE:ASGN)?

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ASGN over the last 18 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

More specifically, Citadel Investment Group was the largest shareholder of ASGN Incorporated (NYSE:ASGN), with a stake worth $28 million reported as of the end of September. Trailing Citadel Investment Group was Brant Point Investment Management, which amassed a stake valued at $3.3 million. Millennium Management, Marshall Wace LLP, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Trellus Management Company allocated the biggest weight to ASGN Incorporated (NYSE:ASGN), around 0.49% of its 13F portfolio. Brant Point Investment Management is also relatively very bullish on the stock, designating 0.42 percent of its 13F equity portfolio to ASGN.

As one would reasonably expect, some big names were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most outsized position in ASGN Incorporated (NYSE:ASGN). Marshall Wace LLP had $2.4 million invested in the company at the end of the quarter. Greg Eisner’s Engineers Gate Manager also made a $0.5 million investment in the stock during the quarter. The other funds with brand new ASGN positions are Brandon Haley’s Holocene Advisors, Matthew Hulsizer’s PEAK6 Capital Management, and Minhua Zhang’s Weld Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to ASGN Incorporated (NYSE:ASGN). These stocks are Evercore Inc. (NYSE:EVR), Triton International Limited (NYSE:TRTN), Karuna Therapeutics, Inc. (NASDAQ:KRTX), and Weingarten Realty Investors (NYSE:WRI). This group of stocks’ market values match ASGN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EVR | 29 | 198051 | -3 |

| TRTN | 12 | 26482 | -4 |

| KRTX | 16 | 148161 | 1 |

| WRI | 20 | 72034 | 0 |

| Average | 19.25 | 111182 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $111 million. That figure was $44 million in ASGN’s case. Evercore Inc. (NYSE:EVR) is the most popular stock in this table. On the other hand Triton International Limited (NYSE:TRTN) is the least popular one with only 12 bullish hedge fund positions. ASGN Incorporated (NYSE:ASGN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th and still beat the market by 17.1 percentage points. A small number of hedge funds were also right about betting on ASGN as the stock returned 93.7% since the end of March and outperformed the market by an even larger margin.

Follow Asgn Inc (NYSE:ASGN)

Follow Asgn Inc (NYSE:ASGN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.