We are still in an overall bull market and many stocks that smart money investors were piling into surged through October 17th. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 45% and 39% respectively. Hedge funds’ top 3 stock picks returned 34.4% this year and beat the S&P 500 ETFs by 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Yamana Gold Inc. (NYSE:AUY).

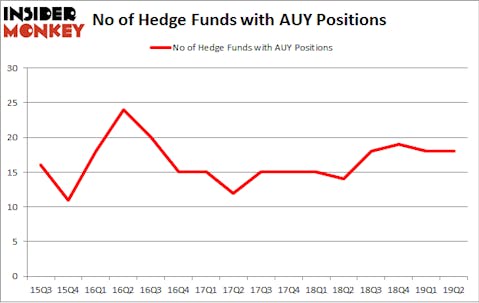

Yamana Gold Inc. (NYSE:AUY) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of June. At the end of this article we will also compare AUY to other stocks including World Fuel Services Corporation (NYSE:INT), PolyOne Corporation (NYSE:POL), and Independent Bank Group Inc (NASDAQ:IBTX) to get a better sense of its popularity. Our calculations also showed that AUY isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most market participants, hedge funds are viewed as underperforming, old financial tools of years past. While there are more than 8000 funds with their doors open at the moment, Our researchers choose to focus on the masters of this group, about 750 funds. These investment experts administer most of all hedge funds’ total capital, and by watching their finest equity investments, Insider Monkey has revealed a number of investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the latest hedge fund action surrounding Yamana Gold Inc. (NYSE:AUY).

What does smart money think about Yamana Gold Inc. (NYSE:AUY)?

Heading into the third quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards AUY over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Yamana Gold Inc. (NYSE:AUY) was held by Renaissance Technologies, which reported holding $38.2 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $21.1 million position. Other investors bullish on the company included Adage Capital Management, Millennium Management, and Moore Global Investments.

Because Yamana Gold Inc. (NYSE:AUY) has experienced a decline in interest from hedge fund managers, it’s easy to see that there exists a select few hedge funds that slashed their full holdings heading into Q3. It’s worth mentioning that David Costen Haley’s HBK Investments dropped the largest position of the “upper crust” of funds watched by Insider Monkey, valued at close to $3.4 million in stock, and Michael Platt and William Reeves’s BlueCrest Capital Mgmt. was right behind this move, as the fund dumped about $0.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Yamana Gold Inc. (NYSE:AUY) but similarly valued. We will take a look at World Fuel Services Corporation (NYSE:INT), PolyOne Corporation (NYSE:POL), Independent Bank Group Inc (NASDAQ:IBTX), and Prospect Capital Corporation (NASDAQ:PSEC). This group of stocks’ market valuations resemble AUY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INT | 19 | 149964 | 1 |

| POL | 24 | 224406 | 1 |

| IBTX | 9 | 95311 | -1 |

| PSEC | 11 | 22786 | 0 |

| Average | 15.75 | 123117 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $123 million. That figure was $121 million in AUY’s case. PolyOne Corporation (NYSE:POL) is the most popular stock in this table. On the other hand Independent Bank Group Inc (NASDAQ:IBTX) is the least popular one with only 9 bullish hedge fund positions. Yamana Gold Inc. (NYSE:AUY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AUY as the stock returned 26.6% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.