Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 of 2018 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETFs by nearly 10 percentage points during the first 11 months of 2019. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Xenon Pharmaceuticals Inc (NASDAQ:XENE) from the perspective of those elite funds.

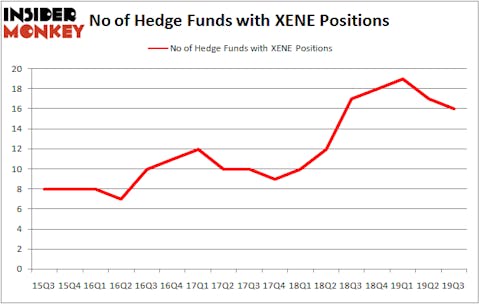

Xenon Pharmaceuticals Inc (NASDAQ:XENE) shareholders have witnessed a decrease in hedge fund interest in recent months. XENE was in 16 hedge funds’ portfolios at the end of the third quarter of 2019. There were 17 hedge funds in our database with XENE holdings at the end of the previous quarter. Our calculations also showed that XENE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most investors, hedge funds are perceived as underperforming, old investment vehicles of years past. While there are greater than 8000 funds with their doors open today, We hone in on the top tier of this club, around 750 funds. These investment experts preside over bulk of the hedge fund industry’s total capital, and by watching their top stock picks, Insider Monkey has found many investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Phill Gross of Adage Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a look at the new hedge fund action encompassing Xenon Pharmaceuticals Inc (NASDAQ:XENE).

How are hedge funds trading Xenon Pharmaceuticals Inc (NASDAQ:XENE)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from the second quarter of 2019. On the other hand, there were a total of 17 hedge funds with a bullish position in XENE a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

The largest stake in Xenon Pharmaceuticals Inc (NASDAQ:XENE) was held by venBio Select Advisor, which reported holding $21.6 million worth of stock at the end of September. It was followed by Biotechnology Value Fund with a $15.7 million position. Other investors bullish on the company included Vivo Capital, Adage Capital Management, and Aquilo Capital Management. In terms of the portfolio weights assigned to each position Aquilo Capital Management allocated the biggest weight to Xenon Pharmaceuticals Inc (NASDAQ:XENE), around 6.04% of its 13F portfolio. Biotechnology Value Fund is also relatively very bullish on the stock, dishing out 1.65 percent of its 13F equity portfolio to XENE.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Athanor Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified XENE as a viable investment and initiated a position in the stock.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Xenon Pharmaceuticals Inc (NASDAQ:XENE) but similarly valued. These stocks are VolitionRX Limited (NYSE:VNRX), Provident Bancorp, Inc. (NASDAQ:PVBC), Concrete Pumping Holdings, Inc. (NASDAQ:BBCP), and Trilogy Metals Inc. (NYSE:TMQ). All of these stocks’ market caps are closest to XENE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNRX | 1 | 378 | 0 |

| PVBC | 3 | 7158 | 1 |

| BBCP | 9 | 45723 | -1 |

| TMQ | 14 | 86483 | 0 |

| Average | 6.75 | 34936 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $101 million in XENE’s case. Trilogy Metals Inc. (NYSE:TMQ) is the most popular stock in this table. On the other hand VolitionRX Limited (NYSE:VNRX) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Xenon Pharmaceuticals Inc (NASDAQ:XENE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on XENE as the stock returned 31.3% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.