Does Xenon Pharmaceuticals Inc (NASDAQ:XENE) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

Is Xenon Pharmaceuticals Inc (NASDAQ:XENE) a buy, sell, or hold? Investors who are in the know are buying. The number of bullish hedge fund positions moved up by 1 in recent months. Our calculations also showed that xene isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are perceived as slow, outdated financial vehicles of the past. While there are greater than 8000 funds trading at the moment, Our experts hone in on the top tier of this club, around 750 funds. It is estimated that this group of investors shepherd most of all hedge funds’ total capital, and by observing their highest performing equity investments, Insider Monkey has figured out several investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the key hedge fund action surrounding Xenon Pharmaceuticals Inc (NASDAQ:XENE).

How are hedge funds trading Xenon Pharmaceuticals Inc (NASDAQ:XENE)?

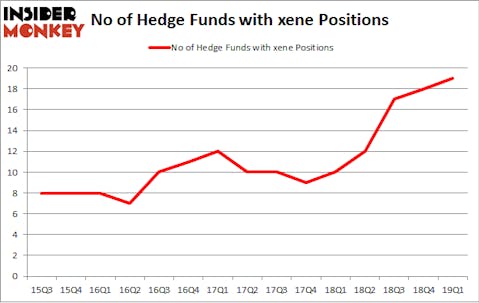

At Q1’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards XENE over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, venBio Select Advisor held the most valuable stake in Xenon Pharmaceuticals Inc (NASDAQ:XENE), which was worth $24.4 million at the end of the first quarter. On the second spot was Biotechnology Value Fund / BVF Inc which amassed $18.2 million worth of shares. Moreover, Vivo Capital, Adage Capital Management, and Aquilo Capital Management were also bullish on Xenon Pharmaceuticals Inc (NASDAQ:XENE), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names have jumped into Xenon Pharmaceuticals Inc (NASDAQ:XENE) headfirst. Winton Capital Management, managed by David Harding, initiated the most valuable position in Xenon Pharmaceuticals Inc (NASDAQ:XENE). Winton Capital Management had $0.1 million invested in the company at the end of the quarter.

Let’s now review hedge fund activity in other stocks similar to Xenon Pharmaceuticals Inc (NASDAQ:XENE). We will take a look at Affimed NV (NASDAQ:AFMD), Panhandle Oil and Gas Inc. (NYSE:PHX), Zagg Inc (NASDAQ:ZAGG), and Teekay Tankers Ltd. (NYSE:TNK). This group of stocks’ market caps match XENE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFMD | 12 | 24969 | 0 |

| PHX | 3 | 37008 | 0 |

| ZAGG | 17 | 16666 | 1 |

| TNK | 12 | 19007 | 1 |

| Average | 11 | 24413 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $120 million in XENE’s case. Zagg Inc (NASDAQ:ZAGG) is the most popular stock in this table. On the other hand Panhandle Oil and Gas Inc. (NYSE:PHX) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Xenon Pharmaceuticals Inc (NASDAQ:XENE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately XENE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on XENE were disappointed as the stock returned -1.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.