Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before the Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Sirius XM Holdings Inc (NASDAQ:SIRI) changed recently.

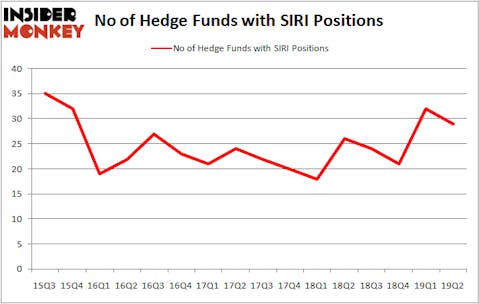

Sirius XM Holdings Inc (NASDAQ:SIRI) was in 29 hedge funds’ portfolios at the end of the second quarter of 2019. SIRI investors should be aware of a decrease in enthusiasm from smart money recently. There were 32 hedge funds in our database with SIRI positions at the end of the previous quarter. Our calculations also showed that SIRI isn’t among the 30 most popular stocks among hedge funds.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the recent hedge fund action surrounding Sirius XM Holdings Inc (NASDAQ:SIRI).

How are hedge funds trading Sirius XM Holdings Inc (NASDAQ:SIRI)?

Heading into the third quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the previous quarter. By comparison, 26 hedge funds held shares or bullish call options in SIRI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the biggest position in Sirius XM Holdings Inc (NASDAQ:SIRI), worth close to $769.6 million, accounting for 0.4% of its total 13F portfolio. The second most bullish fund manager is Zimmer Partners, managed by Stuart J. Zimmer, which holds a $184.1 million position; 1.9% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions encompass Israel Englander’s Millennium Management, Seth Wunder’s Black-and-White Capital and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Because Sirius XM Holdings Inc (NASDAQ:SIRI) has experienced a decline in interest from the smart money, we can see that there was a specific group of fund managers who were dropping their full holdings heading into Q3. Intriguingly, Josh Resnick’s Jericho Capital Asset Management dropped the biggest investment of the 750 funds monitored by Insider Monkey, totaling an estimated $65 million in stock, and Seymour Sy Kaufman and Michael Stark’s Crosslink Capital was right behind this move, as the fund cut about $29.9 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Sirius XM Holdings Inc (NASDAQ:SIRI). These stocks are Cummins Inc. (NYSE:CMI), Coca-Cola European Partners plc (NYSE:CCEP), CRH PLC (NYSE:CRH), and WEC Energy Group, Inc. (NYSE:WEC). This group of stocks’ market valuations resemble SIRI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMI | 45 | 1127412 | 3 |

| CCEP | 10 | 133381 | -3 |

| CRH | 7 | 78961 | 2 |

| WEC | 13 | 392685 | -2 |

| Average | 18.75 | 433110 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $433 million. That figure was $1239 million in SIRI’s case. Cummins Inc. (NYSE:CMI) is the most popular stock in this table. On the other hand CRH PLC (NYSE:CRH) is the least popular one with only 7 bullish hedge fund positions. Sirius XM Holdings Inc (NASDAQ:SIRI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on SIRI as the stock returned 12.4% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.