It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) during the quarter below.

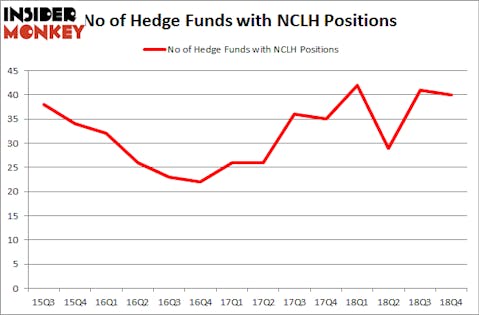

Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) has experienced a decrease in activity from the world’s largest hedge funds in recent months. NCLH was in 40 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 41 hedge funds in our database with NCLH holdings at the end of the previous quarter. Our calculations also showed that NCLH isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are plenty of signals market participants use to analyze stocks. Some of the most underrated signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outclass the market by a very impressive margin (see the details here).

We’re going to analyze the latest hedge fund action surrounding Norwegian Cruise Line Holdings Ltd (NYSE:NCLH).

How have hedgies been trading Norwegian Cruise Line Holdings Ltd (NYSE:NCLH)?

Heading into the first quarter of 2019, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from the second quarter of 2018. On the other hand, there were a total of 42 hedge funds with a bullish position in NCLH a year ago. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, Point72 Asset Management held the most valuable stake in Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), which was worth $105.8 million at the end of the third quarter. On the second spot was Eminence Capital which amassed $90 million worth of shares. Moreover, Two Sigma Advisors, Capital Growth Management, and Laurion Capital Management were also bullish on Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH), allocating a large percentage of their portfolios to this stock.

Since Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) has faced bearish sentiment from hedge fund managers, we can see that there is a sect of fund managers who sold off their positions entirely by the end of the third quarter. Interestingly, Parag Vora’s HG Vora Capital Management dropped the biggest stake of the “upper crust” of funds monitored by Insider Monkey, comprising close to $57.4 million in stock. Ken Grossman and Glen Schneider’s fund, SG Capital Management, also dropped its stock, about $16.7 million worth. These moves are interesting, as total hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) but similarly valued. These stocks are Juniper Networks, Inc. (NYSE:JNPR), Duke Realty Corporation (NYSE:DRE), Iron Mountain Incorporated (NYSE:IRM), and UGI Corp (NYSE:UGI). This group of stocks’ market caps resemble NCLH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JNPR | 29 | 624293 | 6 |

| DRE | 22 | 332523 | 6 |

| IRM | 11 | 48501 | -9 |

| UGI | 24 | 487579 | 5 |

| Average | 21.5 | 373224 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $373 million. That figure was $806 million in NCLH’s case. Juniper Networks, Inc. (NYSE:JNPR) is the most popular stock in this table. On the other hand Iron Mountain Incorporated (NYSE:IRM) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on NCLH as the stock returned 31% and outperformed the market as well. You can see the entire list of these shrewd hedge funds here.

Disclosure: None. This article was originally published at Insider Monkey.