Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 13.5% in the fourth quarter. Seven out of 11 industry groups in the S&P 500 Index were down more than 20% from their 52-week highs at the trough of the stock market crash. The average return of a randomly picked stock in the index was even worse. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 15 most popular S&P 500 stocks among hedge funds not only recouped their Q4 losses but also outperformed the index by more than 3 percentage points. In this article, we will take a look at what hedge funds think about Methode Electronics Inc. (NYSE:MEI).

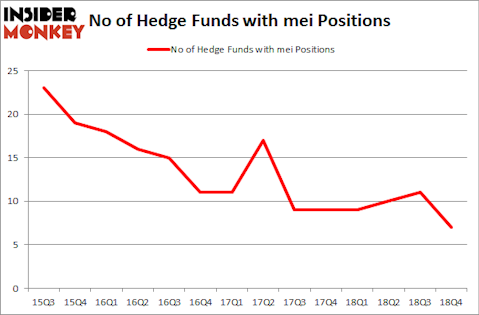

Is Methode Electronics Inc. (NYSE:MEI) an outstanding investment now? Money managers are reducing their bets on the stock. The number of bullish hedge fund positions went down by 4 lately. Our calculations also showed that mei isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Cliff Asness of AQR Capital Management

Let’s take a gander at the key hedge fund action encompassing Methode Electronics Inc. (NYSE:MEI).

How are hedge funds trading Methode Electronics Inc. (NYSE:MEI)?

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -36% from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in MEI a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

More specifically, Ariel Investments was the largest shareholder of Methode Electronics Inc. (NYSE:MEI), with a stake worth $23.7 million reported as of the end of December. Trailing Ariel Investments was Renaissance Technologies, which amassed a stake valued at $20.3 million. Royce & Associates, Citadel Investment Group, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Methode Electronics Inc. (NYSE:MEI) has experienced bearish sentiment from hedge fund managers, we can see that there were a few hedgies that decided to sell off their full holdings by the end of the third quarter. At the top of the heap, Israel Englander’s Millennium Management sold off the biggest position of the “upper crust” of funds watched by Insider Monkey, valued at about $1.1 million in stock. Noam Gottesman’s fund, GLG Partners, also sold off its stock, about $1 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 4 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Methode Electronics Inc. (NYSE:MEI) but similarly valued. These stocks are Despegar.com, Corp. (NYSE:DESP), CTS Corporation (NYSE:CTS), Oil States International, Inc. (NYSE:OIS), and Keane Group, Inc. (NYSE:FRAC). This group of stocks’ market caps are similar to MEI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DESP | 19 | 199969 | 6 |

| CTS | 12 | 86244 | 2 |

| OIS | 10 | 21733 | -1 |

| FRAC | 26 | 441615 | 8 |

| Average | 16.75 | 187390 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $187 million. That figure was $69 million in MEI’s case. Keane Group, Inc. (NYSE:FRAC) is the most popular stock in this table. On the other hand Oil States International, Inc. (NYSE:OIS) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Methode Electronics Inc. (NYSE:MEI) is even less popular than OIS. Hedge funds clearly dropped the ball on MEI as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on MEI as the stock returned 27.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.