Is Lam Research Corporation (NASDAQ:LRCX) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

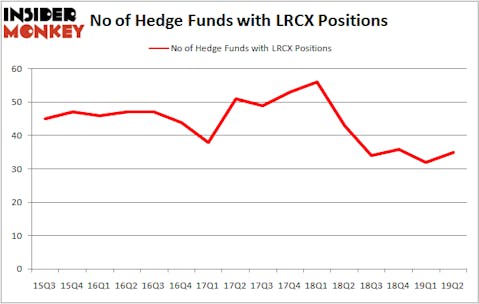

Is Lam Research Corporation (NASDAQ:LRCX) a first-rate investment today? Investors who are in the know are getting more optimistic. The number of bullish hedge fund positions moved up by 3 in recent months. Our calculations also showed that LRCX isn’t among the 30 most popular stocks among hedge funds. LRCX was in 35 hedge funds’ portfolios at the end of June. There were 32 hedge funds in our database with LRCX holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the latest hedge fund action encompassing Lam Research Corporation (NASDAQ:LRCX).

What have hedge funds been doing with Lam Research Corporation (NASDAQ:LRCX)?

At the end of the second quarter, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LRCX over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in Lam Research Corporation (NASDAQ:LRCX). AQR Capital Management has a $295.3 million position in the stock, comprising 0.3% of its 13F portfolio. Coming in second is Lansdowne Partners, managed by Alex Snow, which holds a $149 million position; 3.7% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism consist of Eric W. Mandelblatt and Gaurav Kapadia’s Soroban Capital Partners, Panayotis Takis Sparaggis’s Alkeon Capital Management and Phill Gross and Robert Atchinson’s Adage Capital Management.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. Mike Masters’s Masters Capital Management also initiated a $42.3 million position during the quarter. The other funds with new positions in the stock are Brandon Haley’s Holocene Advisors, Matthew Hulsizer’s PEAK6 Capital Management, and Michael Kharitonov and Jon David McAuliffe’s Voleon Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Lam Research Corporation (NASDAQ:LRCX). These stocks are Republic Services, Inc. (NYSE:RSG), NXP Semiconductors NV (NASDAQ:NXPI), Southwest Airlines Co. (NYSE:LUV), and PPG Industries, Inc. (NYSE:PPG). This group of stocks’ market values match LRCX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RSG | 24 | 635236 | -6 |

| NXPI | 60 | 3941899 | 8 |

| LUV | 33 | 3399759 | -2 |

| PPG | 27 | 929701 | 4 |

| Average | 36 | 2226649 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36 hedge funds with bullish positions and the average amount invested in these stocks was $2227 million. That figure was $1299 million in LRCX’s case. NXP Semiconductors NV (NASDAQ:NXPI) is the most popular stock in this table. On the other hand Republic Services, Inc. (NYSE:RSG) is the least popular one with only 24 bullish hedge fund positions. Lam Research Corporation (NASDAQ:LRCX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on LRCX as the stock returned 23.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.