Is ForeScout Technologies, Inc. (NASDAQ:FSCT) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

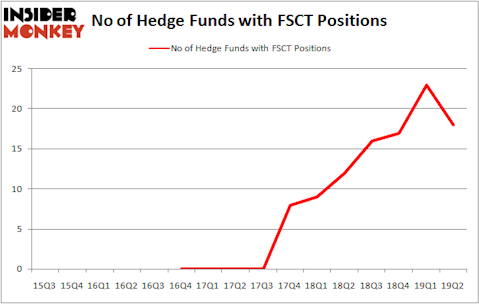

ForeScout Technologies, Inc. (NASDAQ:FSCT) was in 18 hedge funds’ portfolios at the end of the second quarter of 2019. FSCT shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. There were 23 hedge funds in our database with FSCT positions at the end of the previous quarter. Our calculations also showed that FSCT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the latest hedge fund action surrounding ForeScout Technologies, Inc. (NASDAQ:FSCT).

How have hedgies been trading ForeScout Technologies, Inc. (NASDAQ:FSCT)?

At the end of the second quarter, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -22% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards FSCT over the last 16 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jericho Capital Asset Management, managed by Josh Resnick, holds the largest position in ForeScout Technologies, Inc. (NASDAQ:FSCT). Jericho Capital Asset Management has a $113.2 million position in the stock, comprising 5% of its 13F portfolio. Sitting at the No. 2 spot is Corvex Capital, managed by Keith Meister, which holds a $16.4 million position; the fund has 0.6% of its 13F portfolio invested in the stock. Some other peers with similar optimism contain Thomas Ellis and Todd Hammer’s North Run Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Rishi Bajaj, Toby Symonds, and Steve Tesoriere’s Altai Capital.

Because ForeScout Technologies, Inc. (NASDAQ:FSCT) has witnessed declining sentiment from hedge fund managers, logic holds that there was a specific group of hedge funds who were dropping their positions entirely heading into Q3. Interestingly, Louis Bacon’s Moore Global Investments cut the largest stake of all the hedgies tracked by Insider Monkey, valued at about $12.2 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund sold off about $9.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 5 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ForeScout Technologies, Inc. (NASDAQ:FSCT) but similarly valued. These stocks are Southwestern Energy Company (NYSE:SWN), FBL Financial Group, Inc. (NYSE:FFG), Cambrex Corporation (NYSE:CBM), and PriceSmart, Inc. (NASDAQ:PSMT). This group of stocks’ market values resemble FSCT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWN | 18 | 256829 | -6 |

| FFG | 7 | 12886 | 0 |

| CBM | 12 | 30487 | -1 |

| PSMT | 15 | 60518 | 5 |

| Average | 13 | 90180 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $90 million. That figure was $192 million in FSCT’s case. Southwestern Energy Company (NYSE:SWN) is the most popular stock in this table. On the other hand FBL Financial Group, Inc. (NYSE:FFG) is the least popular one with only 7 bullish hedge fund positions. ForeScout Technologies, Inc. (NASDAQ:FSCT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on FSCT as the stock returned 12% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.