There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Corcept Therapeutics Incorporated (NASDAQ:CORT).

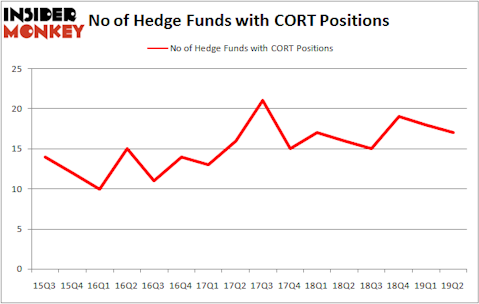

Corcept Therapeutics Incorporated (NASDAQ:CORT) shareholders have witnessed a decrease in enthusiasm from smart money of late. CORT was in 17 hedge funds’ portfolios at the end of June. There were 18 hedge funds in our database with CORT positions at the end of the previous quarter. Our calculations also showed that CORT isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are perceived as worthless, old financial vehicles of the past. While there are more than 8000 funds with their doors open at present, Our researchers hone in on the bigwigs of this group, approximately 750 funds. These hedge fund managers administer bulk of all hedge funds’ total asset base, and by tracking their finest stock picks, Insider Monkey has identified a few investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the recent hedge fund action regarding Corcept Therapeutics Incorporated (NASDAQ:CORT).

What have hedge funds been doing with Corcept Therapeutics Incorporated (NASDAQ:CORT)?

Heading into the third quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in CORT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Corcept Therapeutics Incorporated (NASDAQ:CORT), with a stake worth $62.3 million reported as of the end of March. Trailing Renaissance Technologies was Consonance Capital Management, which amassed a stake valued at $32.1 million. Citadel Investment Group, Marshall Wace LLP, and Tudor Investment Corp were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Corcept Therapeutics Incorporated (NASDAQ:CORT) has experienced falling interest from the smart money, it’s easy to see that there is a sect of hedge funds that elected to cut their entire stakes last quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital dropped the largest position of the 750 funds watched by Insider Monkey, worth about $3.7 million in stock, and Jeffrey Talpins’s Element Capital Management was right behind this move, as the fund cut about $0.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Corcept Therapeutics Incorporated (NASDAQ:CORT) but similarly valued. We will take a look at The E.W. Scripps Company (NASDAQ:SSP), Kornit Digital Ltd. (NASDAQ:KRNT), Sleep Number Corporation (NASDAQ:SNBR), and Kearny Financial Corp. (NASDAQ:KRNY). This group of stocks’ market caps match CORT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSP | 17 | 152520 | -8 |

| KRNT | 13 | 57228 | 3 |

| SNBR | 16 | 114555 | -4 |

| KRNY | 13 | 139904 | -3 |

| Average | 14.75 | 116052 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $116 million. That figure was $124 million in CORT’s case. The E.W. Scripps Company (NASDAQ:SSP) is the most popular stock in this table. On the other hand Kornit Digital Ltd. (NASDAQ:KRNT) is the least popular one with only 13 bullish hedge fund positions. Corcept Therapeutics Incorporated (NASDAQ:CORT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on CORT as the stock returned 26.8% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.