At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

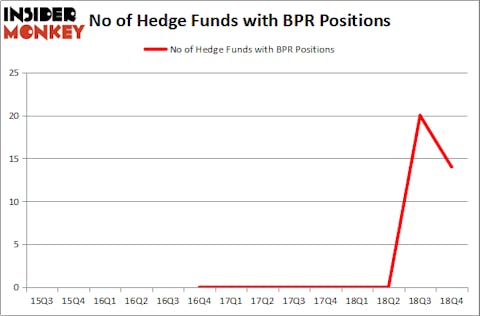

Is Brookfield Property REIT Inc. (NASDAQ:BPR) ready to rally soon? The smart money is in a bearish mood. The number of long hedge fund positions fell by 6 in recent months. Our calculations also showed that BPR isn’t among the 30 most popular stocks among hedge funds. BPR was in 14 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 20 hedge funds in our database with BPR holdings at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the latest hedge fund action encompassing Brookfield Property REIT Inc. (NASDAQ:BPR).

How are hedge funds trading Brookfield Property REIT Inc. (NASDAQ:BPR)?

Heading into the first quarter of 2019, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -30% from the previous quarter. On the other hand, there were a total of 0 hedge funds with a bullish position in BPR a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, D E Shaw, managed by D. E. Shaw, holds the number one position in Brookfield Property REIT Inc. (NASDAQ:BPR). D E Shaw has a $60.7 million position in the stock, comprising 0.1% of its 13F portfolio. On D E Shaw’s heels is Shane Finemore of Manikay Partners, with a $49.3 million position; the fund has 4.8% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass Paul Marshall and Ian Wace’s Marshall Wace LLP, Israel Englander’s Millennium Management and Phillip Goldstein, Andrew Dakos and Steven Samuels’s Bulldog Investors.

Because Brookfield Property REIT Inc. (NASDAQ:BPR) has experienced declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of funds that slashed their positions entirely by the end of the third quarter. Intriguingly, Thomas Steyer’s Farallon Capital dumped the biggest investment of the 700 funds monitored by Insider Monkey, totaling close to $168.6 million in stock. Richard Gerson and Navroz D. Udwadia’s fund, Falcon Edge Capital, also cut its stock, about $26.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 6 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Brookfield Property REIT Inc. (NASDAQ:BPR) but similarly valued. We will take a look at FirstService Corporation (TSE:FSV), Quaker Chemical Corp (NYSE:KWR), Blueprint Medicines Corporation (NASDAQ:BPMC), and Red Rock Resorts, Inc. (NASDAQ:RRR). This group of stocks’ market values are similar to BPR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSV | 13 | 123401 | 0 |

| KWR | 13 | 148763 | 2 |

| BPMC | 22 | 391311 | -5 |

| RRR | 17 | 304726 | -4 |

| Average | 16.25 | 242050 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $242 million. That figure was $144 million in BPR’s case. Blueprint Medicines Corporation (NASDAQ:BPMC) is the most popular stock in this table. On the other hand FirstService Corporation (TSE:FSV) is the least popular one with only 13 bullish hedge fund positions. Brookfield Property REIT Inc. (NASDAQ:BPR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on BPR as the stock returned 31.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.