Does B. Riley Financial, Inc. (NASDAQ:RILY) represent a good buying opportunity at the moment? Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

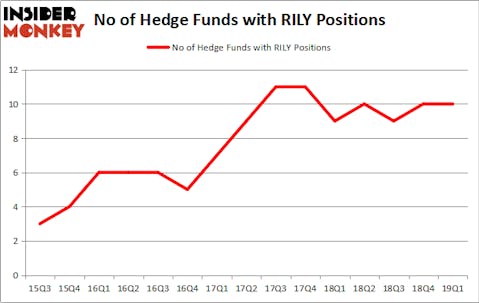

B. Riley Financial, Inc. (NASDAQ:RILY) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare RILY to other stocks including Greenhill & Co., Inc. (NYSE:GHL), Priority Technology Holdings, Inc. (NASDAQ:PRTH), and Cytokinetics, Inc. (NASDAQ:CYTK) to get a better sense of its popularity.

If you’d ask most investors, hedge funds are perceived as underperforming, outdated financial vehicles of yesteryear. While there are more than 8000 funds trading today, Our experts hone in on the aristocrats of this group, approximately 750 funds. Most estimates calculate that this group of people manage most of the smart money’s total asset base, and by keeping an eye on their unrivaled stock picks, Insider Monkey has identified a number of investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a glance at the latest hedge fund action encompassing B. Riley Financial, Inc. (NASDAQ:RILY).

How are hedge funds trading B. Riley Financial, Inc. (NASDAQ:RILY)?

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RILY over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Elliott Management held the most valuable stake in B. Riley Financial, Inc. (NASDAQ:RILY), which was worth $38.5 million at the end of the first quarter. On the second spot was Nokomis Capital which amassed $27.4 million worth of shares. Moreover, Royce & Associates, Manatuck Hill Partners, and Ancora Advisors were also bullish on B. Riley Financial, Inc. (NASDAQ:RILY), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Marshall Wace LLP. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Winton Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to B. Riley Financial, Inc. (NASDAQ:RILY). These stocks are Greenhill & Co., Inc. (NYSE:GHL), Priority Technology Holdings, Inc. (NASDAQ:PRTH), Cytokinetics, Inc. (NASDAQ:CYTK), and The York Water Company (NASDAQ:YORW). This group of stocks’ market caps resemble RILY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GHL | 15 | 40189 | 2 |

| PRTH | 2 | 4360 | -1 |

| CYTK | 16 | 69419 | 0 |

| YORW | 5 | 17100 | 0 |

| Average | 9.5 | 32767 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $33 million. That figure was $85 million in RILY’s case. Cytokinetics, Inc. (NASDAQ:CYTK) is the most popular stock in this table. On the other hand Priority Technology Holdings, Inc. (NASDAQ:PRTH) is the least popular one with only 2 bullish hedge fund positions. B. Riley Financial, Inc. (NASDAQ:RILY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on RILY as the stock returned 21.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.