Reputable billionaire investors such as Jim Simons, Cliff Asness and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

Is Avon Products, Inc. (NYSE:AVP) a splendid investment now? Money managers are in a bearish mood. The number of bullish hedge fund bets shrunk by 2 in recent months. Our calculations also showed that AVP isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are seen as underperforming, outdated investment vehicles of the past. While there are over 8000 funds in operation at the moment, We choose to focus on the leaders of this club, about 750 funds. Most estimates calculate that this group of people direct the majority of the hedge fund industry’s total asset base, and by keeping track of their first-class equity investments, Insider Monkey has uncovered numerous investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the latest hedge fund action encompassing Avon Products, Inc. (NYSE:AVP).

What have hedge funds been doing with Avon Products, Inc. (NYSE:AVP)?

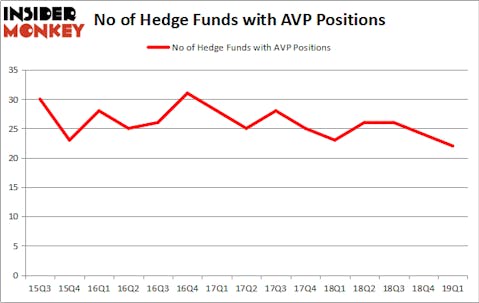

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AVP over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in Avon Products, Inc. (NYSE:AVP), worth close to $70.6 million, amounting to 0.1% of its total 13F portfolio. Coming in second is Yacktman Asset Management, managed by Donald Yacktman, which holds a $45.1 million position; 0.6% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism consist of Constantinos J. Christofilis’s Archon Capital Management, Himanshu H. Shah’s Shah Capital Management and Chuck Royce’s Royce & Associates.

Due to the fact that Avon Products, Inc. (NYSE:AVP) has witnessed falling interest from hedge fund managers, it’s easy to see that there exists a select few funds that elected to cut their entire stakes last quarter. Interestingly, Phil Frohlich’s Prescott Group Capital Management dropped the largest stake of all the hedgies monitored by Insider Monkey, worth an estimated $1.6 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $0.9 million worth. These transactions are important to note, as total hedge fund interest dropped by 2 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Avon Products, Inc. (NYSE:AVP). These stocks are Natera Inc (NASDAQ:NTRA), First Majestic Silver Corp (NYSE:AG), Varex Imaging Corporation (NASDAQ:VREX), and Alector, Inc. (NASDAQ:ALEC). This group of stocks’ market caps resemble AVP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTRA | 18 | 154179 | 1 |

| AG | 8 | 8553 | -2 |

| VREX | 20 | 110554 | 5 |

| ALEC | 12 | 358037 | 12 |

| Average | 14.5 | 157831 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $158 million. That figure was $260 million in AVP’s case. Varex Imaging Corporation (NASDAQ:VREX) is the most popular stock in this table. On the other hand First Majestic Silver Corp (NYSE:AG) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Avon Products, Inc. (NYSE:AVP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on AVP as the stock returned 37.1% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.