At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Denali Therapeutics Inc. (NASDAQ:DNLI) makes for a good investment right now.

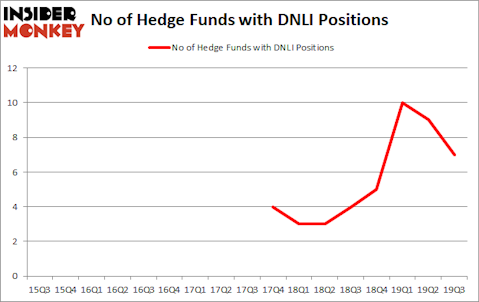

Is Denali Therapeutics Inc. (NASDAQ:DNLI) a healthy stock for your portfolio? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund positions were cut by 2 recently. Our calculations also showed that DNLI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of methods shareholders use to evaluate stocks. A duo of the most innovative methods are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the S&P 500 by a healthy margin (see the details here).

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s take a gander at the fresh hedge fund action encompassing Denali Therapeutics Inc. (NASDAQ:DNLI).

What does smart money think about Denali Therapeutics Inc. (NASDAQ:DNLI)?

At the end of the third quarter, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -22% from the second quarter of 2019. By comparison, 4 hedge funds held shares or bullish call options in DNLI a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Denali Therapeutics Inc. (NASDAQ:DNLI) was held by Casdin Capital, which reported holding $8.3 million worth of stock at the end of September. It was followed by Millennium Management with a $1.6 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Mark Asset Management. In terms of the portfolio weights assigned to each position Casdin Capital allocated the biggest weight to Denali Therapeutics Inc. (NASDAQ:DNLI), around 0.83% of its 13F portfolio. Mark Asset Management is also relatively very bullish on the stock, setting aside 0.26 percent of its 13F equity portfolio to DNLI.

Seeing as Denali Therapeutics Inc. (NASDAQ:DNLI) has experienced declining sentiment from the aggregate hedge fund industry, logic holds that there were a few hedge funds who were dropping their full holdings in the third quarter. Interestingly, Dmitry Balyasny’s Balyasny Asset Management dumped the largest stake of all the hedgies followed by Insider Monkey, worth close to $2.5 million in stock. David E. Shaw’s fund, D E Shaw, also dumped its stock, about $2.1 million worth. These transactions are interesting, as total hedge fund interest was cut by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Denali Therapeutics Inc. (NASDAQ:DNLI) but similarly valued. We will take a look at FBL Financial Group (NYSE:FFG), TPG RE Finance Trust, Inc. (NYSE:TRTX), Tootsie Roll Industries, Inc. (NYSE:TR), and Core-Mark Holding Company, Inc. (NASDAQ:CORE). This group of stocks’ market caps are similar to DNLI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FFG | 8 | 16754 | 1 |

| TRTX | 10 | 45884 | 1 |

| TR | 17 | 92174 | 4 |

| CORE | 18 | 50919 | -6 |

| Average | 13.25 | 51433 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $14 million in DNLI’s case. Core-Mark Holding Company, Inc. (NASDAQ:CORE) is the most popular stock in this table. On the other hand FBL Financial Group (NYSE:FFG) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Denali Therapeutics Inc. (NASDAQ:DNLI) is even less popular than FFG. Hedge funds clearly dropped the ball on DNLI as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on DNLI as the stock returned 16.1% during the fourth quarter (through the end of November) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.