Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the nearly unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Hedge fund interest in Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare PLAY to other stocks including Callon Petroleum Company (NYSE:CPE), Blucora Inc (NASDAQ:BCOR), and G-III Apparel Group, Ltd. (NASDAQ:GIII) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are several indicators stock traders use to evaluate their stock investments. A couple of the most useful indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can beat the market by a solid amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the latest hedge fund action surrounding Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY).

What have hedge funds been doing with Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY)?

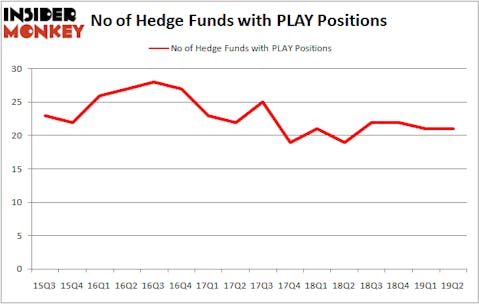

At Q2’s end, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 19 hedge funds held shares or bullish call options in PLAY a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) was held by HG Vora Capital Management, which reported holding $80.9 million worth of stock at the end of March. It was followed by Hill Path Capital with a $73.2 million position. Other investors bullish on the company included Arrowstreet Capital, Blue Harbour Group, and Indaba Capital Management.

Seeing as Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) has experienced bearish sentiment from the smart money, it’s easy to see that there was a specific group of hedgies who were dropping their positions entirely heading into Q3. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP sold off the largest stake of the “upper crust” of funds tracked by Insider Monkey, valued at an estimated $13.8 million in stock. Renaissance Technologies, also said goodbye to its stock, about $7.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY). These stocks are Callon Petroleum Company (NYSE:CPE), Blucora Inc (NASDAQ:BCOR), G-III Apparel Group, Ltd. (NASDAQ:GIII), and Cloudera, Inc. (NYSE:CLDR). This group of stocks’ market values resemble PLAY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPE | 12 | 166161 | -11 |

| BCOR | 16 | 127514 | 4 |

| GIII | 13 | 74478 | -5 |

| CLDR | 25 | 129316 | -7 |

| Average | 16.5 | 124367 | -4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $124 million. That figure was $332 million in PLAY’s case. Cloudera, Inc. (NYSE:CLDR) is the most popular stock in this table. On the other hand Callon Petroleum Company (NYSE:CPE) is the least popular one with only 12 bullish hedge fund positions. Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PLAY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PLAY were disappointed as the stock returned -3.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.