We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 57% each. Hedge funds’ top 3 stock picks returned 45.7% last year and beat the S&P 500 ETFs by more than 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Conduent Incorporated (NASDAQ:CNDT).

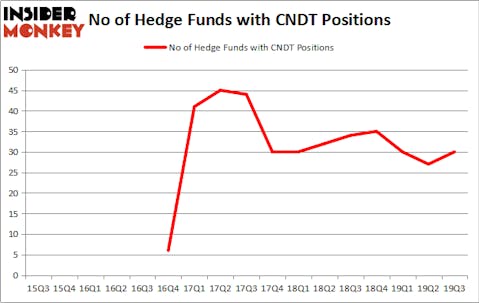

Conduent Incorporated (NASDAQ:CNDT) has seen an increase in hedge fund sentiment of late. Our calculations also showed that CNDT isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To most stock holders, hedge funds are viewed as worthless, outdated investment vehicles of the past. While there are over 8000 funds in operation at the moment, We hone in on the masters of this club, approximately 750 funds. It is estimated that this group of investors direct bulk of the hedge fund industry’s total capital, and by keeping track of their inimitable equity investments, Insider Monkey has deciphered a number of investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Carl Icahn of Icahn Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now we’re going to review the key hedge fund action regarding Conduent Incorporated (NASDAQ:CNDT).

Hedge fund activity in Conduent Incorporated (NASDAQ:CNDT)

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the second quarter of 2019. On the other hand, there were a total of 34 hedge funds with a bullish position in CNDT a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Carl Icahn’s Icahn Capital has the biggest position in Conduent Incorporated (NASDAQ:CNDT), worth close to $237.3 million, amounting to 0.9% of its total 13F portfolio. Sitting at the No. 2 spot is David Cohen and Harold Levy of Iridian Asset Management, with a $49.2 million position; 0.8% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions include Renaissance Technologies, David E. Shaw’s D E Shaw and Michael A. Price and Amos Meron’s Empyrean Capital Partners. In terms of the portfolio weights assigned to each position Clearline Capital allocated the biggest weight to Conduent Incorporated (NASDAQ:CNDT), around 3.18% of its 13F portfolio. Icahn Capital is also relatively very bullish on the stock, setting aside 0.92 percent of its 13F equity portfolio to CNDT.

As aggregate interest increased, key money managers have jumped into Conduent Incorporated (NASDAQ:CNDT) headfirst. Empyrean Capital Partners, managed by Michael A. Price and Amos Meron, initiated the largest position in Conduent Incorporated (NASDAQ:CNDT). Empyrean Capital Partners had $13 million invested in the company at the end of the quarter. Sculptor Capital also made a $5.8 million investment in the stock during the quarter. The other funds with brand new CNDT positions are Dmitry Balyasny’s Balyasny Asset Management, Ken Griffin’s Citadel Investment Group, and Simon Sadler’s Segantii Capital.

Let’s also examine hedge fund activity in other stocks similar to Conduent Incorporated (NASDAQ:CNDT). These stocks are Helios Technologies, Inc. (NASDAQ:HLIO), Seacoast Banking Corporation of Florida (NASDAQ:SBCF), Veritex Holdings Inc (NASDAQ:VBTX), and Independence Realty Trust Inc (NYSE:IRT). This group of stocks’ market valuations resemble CNDT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLIO | 3 | 75356 | -1 |

| SBCF | 6 | 22958 | 0 |

| VBTX | 9 | 85782 | 1 |

| IRT | 12 | 95303 | 4 |

| Average | 7.5 | 69850 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $418 million in CNDT’s case. Independence Realty Trust Inc (NYSE:IRT) is the most popular stock in this table. On the other hand Helios Technologies, Inc. (NASDAQ:HLIO) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Conduent Incorporated (NASDAQ:CNDT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately CNDT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CNDT were disappointed as the stock returned -41.7% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.