Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Choice Hotels International, Inc. (NYSE:CHH).

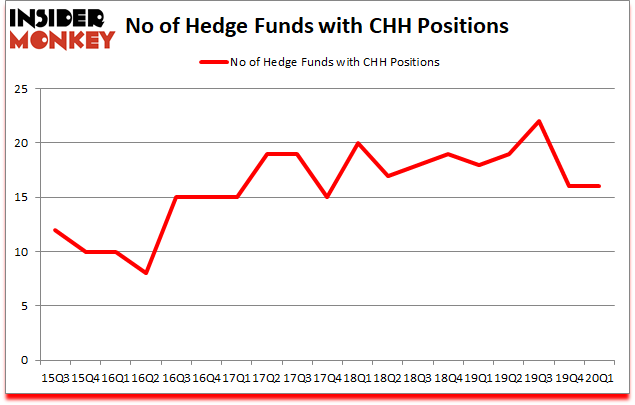

Choice Hotels International, Inc. (NYSE:CHH) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 16 hedge funds’ portfolios at the end of the first quarter of 2020. At the end of this article we will also compare CHH to other stocks including Tata Motors Limited (NYSE:TTM), Aluminum Corp. of China Limited (NYSE:ACH), and Acuity Brands, Inc. (NYSE:AYI) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are tons of signals investors can use to appraise publicly traded companies. Two of the most underrated signals are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the top investment managers can outperform their index-focused peers by a significant margin (see the details here).

Tom Gayner of Markel Gayner Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, We take a look at lists like the 10 stocks that went up during the 2008 crash to identify the companies that are likely to deliver double digit returns in up and down markets. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to review the key hedge fund action encompassing Choice Hotels International, Inc. (NYSE:CHH).

How are hedge funds trading Choice Hotels International, Inc. (NYSE:CHH)?

Heading into the second quarter of 2020, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CHH over the last 18 quarters. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Echo Street Capital Management, managed by Greg Poole, holds the most valuable position in Choice Hotels International, Inc. (NYSE:CHH). Echo Street Capital Management has a $28.2 million position in the stock, comprising 0.6% of its 13F portfolio. The second most bullish fund manager is Dmitry Balyasny of Balyasny Asset Management, with a $25.1 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish consist of Tom Gayner’s Markel Gayner Asset Management, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Echo Street Capital Management allocated the biggest weight to Choice Hotels International, Inc. (NYSE:CHH), around 0.61% of its 13F portfolio. Balyasny Asset Management is also relatively very bullish on the stock, earmarking 0.3 percent of its 13F equity portfolio to CHH.

Because Choice Hotels International, Inc. (NYSE:CHH) has experienced bearish sentiment from the smart money, it’s safe to say that there was a specific group of hedge funds that slashed their full holdings last quarter. Interestingly, Brandon Haley’s Holocene Advisors cut the biggest stake of all the hedgies watched by Insider Monkey, totaling close to $4.2 million in stock. Ray Dalio’s fund, Bridgewater Associates, also cut its stock, about $1.3 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Choice Hotels International, Inc. (NYSE:CHH) but similarly valued. These stocks are Tata Motors Limited (NYSE:TTM), Aluminum Corp. of China Limited (NYSE:ACH), Acuity Brands, Inc. (NYSE:AYI), and Companhia Brasileira de Distrib. (NYSE:CBD). This group of stocks’ market caps are closest to CHH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTM | 10 | 60931 | -1 |

| ACH | 2 | 2417 | -1 |

| AYI | 31 | 498648 | 2 |

| CBD | 5 | 7159 | -4 |

| Average | 12 | 142289 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $142 million. That figure was $102 million in CHH’s case. Acuity Brands, Inc. (NYSE:AYI) is the most popular stock in this table. On the other hand Aluminum Corp. of China Limited (NYSE:ACH) is the least popular one with only 2 bullish hedge fund positions. Choice Hotels International, Inc. (NYSE:CHH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on CHH as the stock returned 27.9% in Q2 (through June 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Choice Hotels International Inc (NYSE:CHH)

Follow Choice Hotels International Inc (NYSE:CHH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.