We at Insider Monkey have gone over 738 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st. In this article, we look at what those funds think of Choice Hotels International, Inc. (NYSE:CHH) based on that data.

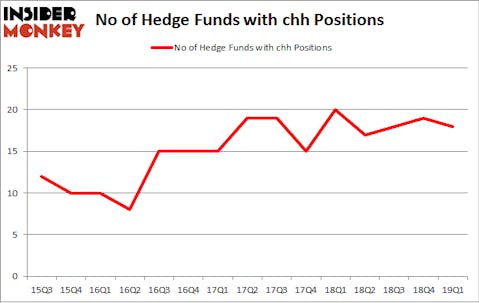

Is Choice Hotels International, Inc. (NYSE:CHH) going to take off soon? Money managers are taking a pessimistic view. The number of long hedge fund positions decreased by 1 in recent months. Our calculations also showed that chh isn’t among the 30 most popular stocks among hedge funds. CHH was in 18 hedge funds’ portfolios at the end of the first quarter of 2019. There were 19 hedge funds in our database with CHH positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the fresh hedge fund action encompassing Choice Hotels International, Inc. (NYSE:CHH).

What have hedge funds been doing with Choice Hotels International, Inc. (NYSE:CHH)?

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CHH over the last 15 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Greg Poole’s Echo Street Capital Management has the largest position in Choice Hotels International, Inc. (NYSE:CHH), worth close to $152.9 million, amounting to 3% of its total 13F portfolio. Coming in second is John Brennan of Sirios Capital Management, with a $29.9 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions contain Dmitry Balyasny’s Balyasny Asset Management, Noam Gottesman’s GLG Partners and Tom Gayner’s Markel Gayner Asset Management.

Because Choice Hotels International, Inc. (NYSE:CHH) has faced falling interest from the aggregate hedge fund industry, logic holds that there is a sect of funds that decided to sell off their full holdings heading into Q3. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP dropped the largest position of all the hedgies watched by Insider Monkey, totaling about $11.2 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $6.8 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Choice Hotels International, Inc. (NYSE:CHH) but similarly valued. We will take a look at Hospitality Properties Trust (NASDAQ:HPT), Spark Therapeutics Inc (NASDAQ:ONCE), Western Alliance Bancorporation (NYSE:WAL), and OneMain Holdings Inc (NYSE:OMF). This group of stocks’ market valuations are similar to CHH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPT | 11 | 68312 | -5 |

| ONCE | 36 | 1167154 | 21 |

| WAL | 28 | 288568 | 0 |

| OMF | 31 | 237512 | 9 |

| Average | 26.5 | 440387 | 6.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $440 million. That figure was $272 million in CHH’s case. Spark Therapeutics Inc (NASDAQ:ONCE) is the most popular stock in this table. On the other hand Hospitality Properties Trust (NASDAQ:HPT) is the least popular one with only 11 bullish hedge fund positions. Choice Hotels International, Inc. (NYSE:CHH) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on CHH as the stock returned 6.8% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.