Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Bank of America Corporation (NYSE:BAC).

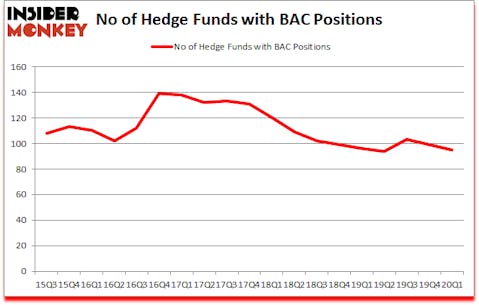

Bank of America Corporation (NYSE:BAC) investors should be aware of a decrease in activity from the world’s largest hedge funds of late. BAC was in 95 hedge funds’ portfolios at the end of March. There were 99 hedge funds in our database with BAC holdings at the end of the previous quarter. Our calculations also showed that BAC is still among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are viewed as underperforming, old financial tools of yesteryear. While there are greater than 8000 funds with their doors open at the moment, Our experts choose to focus on the crème de la crème of this club, about 850 funds. It is estimated that this group of investors orchestrate most of the hedge fund industry’s total asset base, and by paying attention to their unrivaled stock picks, Insider Monkey has formulated various investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we asked astrophysicist Neil deGrasse Tyson about Tesla, Elon Musk, and his top stock picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a look at the recent hedge fund action surrounding Bank of America Corporation (NYSE:BAC).

How are hedge funds trading Bank of America Corporation (NYSE:BAC)?

At the end of the first quarter, a total of 95 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the previous quarter. By comparison, 96 hedge funds held shares or bullish call options in BAC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Berkshire Hathaway held the most valuable stake in Bank of America Corporation (NYSE:BAC), which was worth $19637.9 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $376 million worth of shares. Pzena Investment Management, Steadfast Capital Management, and First Pacific Advisors LLC were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Berkshire Hathaway allocated the biggest weight to Bank of America Corporation (NYSE:BAC), around 11.19% of its 13F portfolio. Aquamarine Capital Management is also relatively very bullish on the stock, setting aside 11.12 percent of its 13F equity portfolio to BAC.

Since Bank of America Corporation (NYSE:BAC) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there exists a select few money managers who sold off their entire stakes heading into Q4. It’s worth mentioning that Rajiv Jain’s GQG Partners dumped the largest position of the “upper crust” of funds followed by Insider Monkey, valued at about $509.2 million in stock. Patrick Degorce’s fund, Theleme Partners, also dumped its stock, about $418.5 million worth. These moves are important to note, as total hedge fund interest fell by 4 funds heading into Q4.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Bank of America Corporation (NYSE:BAC) but similarly valued. We will take a look at Pfizer Inc. (NYSE:PFE), The Walt Disney Company (NYSE:DIS), Toyota Motor Corporation (NYSE:TM), and PepsiCo, Inc. (NASDAQ:PEP). This group of stocks’ market values resemble BAC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFE | 67 | 3159878 | 5 |

| DIS | 102 | 4701800 | -16 |

| TM | 11 | 206410 | -1 |

| PEP | 57 | 2820020 | -2 |

| Average | 59.25 | 2722027 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 59.25 hedge funds with bullish positions and the average amount invested in these stocks was $2722 million. That figure was $21722 million in BAC’s case. The Walt Disney Company (NYSE:DIS) is the most popular stock in this table. On the other hand Toyota Motor Corporation (NYSE:TM) is the least popular one with only 11 bullish hedge fund positions. Bank of America Corporation (NYSE:BAC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but beat the market by 15.6 percentage points. Unfortunately BAC wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on BAC were disappointed as the stock returned 6.7% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.