With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was Avangrid, Inc. (NYSE:AGR).

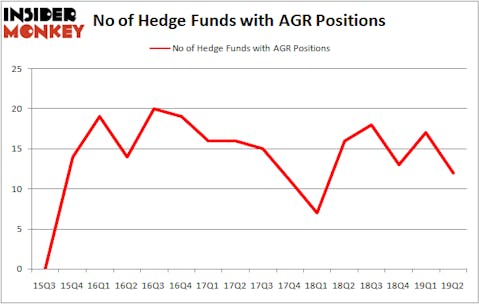

Avangrid, Inc. (NYSE:AGR) was in 12 hedge funds’ portfolios at the end of June. AGR investors should be aware of a decrease in enthusiasm from smart money recently. There were 17 hedge funds in our database with AGR holdings at the end of the previous quarter. Our calculations also showed that AGR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of formulas investors use to grade stocks. Two of the less utilized formulas are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the elite hedge fund managers can outpace the market by a superb amount (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the latest hedge fund action regarding Avangrid, Inc. (NYSE:AGR).

How are hedge funds trading Avangrid, Inc. (NYSE:AGR)?

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -29% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards AGR over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pzena Investment Management held the most valuable stake in Avangrid, Inc. (NYSE:AGR), which was worth $107.2 million at the end of the second quarter. On the second spot was Electron Capital Partners which amassed $72.9 million worth of shares. Moreover, Renaissance Technologies, Covalis Capital, and GLG Partners were also bullish on Avangrid, Inc. (NYSE:AGR), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Avangrid, Inc. (NYSE:AGR) has faced falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of money managers that slashed their full holdings last quarter. At the top of the heap, Alex Snow’s Lansdowne Partners said goodbye to the largest investment of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $32.1 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $6.1 million worth. These transactions are interesting, as total hedge fund interest fell by 5 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Avangrid, Inc. (NYSE:AGR). These stocks are Lennar Corporation (NYSE:LEN), Deutsche Bank Aktiengesellschaft (NYSE:DB), HCP, Inc. (NYSE:HCP), and MGM Resorts International (NYSE:MGM). This group of stocks’ market values are similar to AGR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LEN | 53 | 1832701 | -8 |

| DB | 11 | 1015885 | -2 |

| HCP | 26 | 634618 | 0 |

| MGM | 35 | 1982659 | -10 |

| Average | 31.25 | 1366466 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $1366 million. That figure was $325 million in AGR’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand Deutsche Bank Aktiengesellschaft (NYSE:DB) is the least popular one with only 11 bullish hedge fund positions. Avangrid, Inc. (NYSE:AGR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on AGR, though not to the same extent, as the stock returned 4.4% during the third quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.